Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

HILTON: ROOM FOR

STRONG GROWTH

With over 7 600 hotels and 1.2 million rooms globally, hotel group Hilton Worldwide Holdings is, in our view, an exceptional business – it has the highly desirable attributes of structural growth tailwinds, a high return on invested capital, competitive advantages, growing free cash flows as well as a reasonable valuation. We recently added the company to the Sanlam Global High Quality Fund.

Hilton operates as an asset-light franchisor of its hotel brands and owns very few physical hotel properties. Its 22 brands cover the chain scale spectrum from luxury through midscale to economy. These include the Waldorf Astoria and Conrad Hotels (luxury), Hilton Hotels (upper upscale), DoubleTree by Hilton and Hilton Garden Inn (upscale), Hampton by Hilton and Home2 Suites (upper midscale), Spark (premium economy) and Homewood Suites (extended stay).

Listed on the New York Stock Exchange under the ticker HLT, Hilton is an excellent business, for the following reasons:

Hilton franchises its hotel brands to property owners. Capital for new hotel properties is put up by franchisees, including the costs of building the hotel, all property maintenance and all ongoing expenses such as hiring staff and utilities costs. The franchisee pays Hilton a franchise fee for every room night sold, which (keeping it simple) amounts to around 5% of the bill. In return, the hotel owner gets access to a Hilton brand, and the group’s know-how, booking systems and loyalty programme.

Being able to access the loyalty programme with its 180 million members is a key selling point for hotel owners to convert to Hilton brands, as 64% of bookings for Hilton hotels are done directly through the loyalty system. On these directly booked nights, the hotel property owner does not pay a high booking fee to intermediaries such as Booking.com or Expedia.com. In short, being part of the Hilton system is more profitable for a hotel owner than being an independent hotel.

Hilton also offers ancillary services such as hotel management, where it manages some of its hotels when the franchisees don’t want to do so themselves. In this model, the hotel owner remains liable for all costs, including staff and maintenance expenses, with Hilton being paid a base fee and an incentive profit-sharing fee for managing the hotel.

Simplifying it all, Hilton grows revenues as it adds hotels and rooms to the system (volume growth). Also, revenue per room night sold generally goes up in line or slightly ahead of inflation over time (pricing power keeps up with inflation over long cycles). Because the new rooms added each year are very high fee-margin rooms, operating margin rises over time too. Around 96% of group profits are earned by the franchised and managed fee business, which is the group division that is growing – it operates at 78% EBIT margins.

The key ongoing trend in the hotel industry is a shift away from independent hotels towards brands, for the reasons explained above. Branded hotels are growing their market share in all geographies. By its own estimates, Hilton currently has a 5% global market share of hotel rooms, but a 20% share of all rooms under construction globally. For example, Hilton enjoys a 14% share in its biggest market – the US – but has 23% of all new rooms under construction there. In Asia-Pacific, Hilton has a 2% market share but 24% of rooms under construction. In Europe, a very big hotel market, these figures are 2% and 10% respectively.

The raw numbers on the development pipeline are impressive. As of 31 March 2024, Hilton has 7 626 existing hotels and 1 997 000 rooms, with a new pipeline of another 472 000 rooms. This represents 39% of its existing global estate, to be added to its system over the next five years. Half of these rooms are already under construction. Just to repeat: Hilton is not funding the cost of this expansion – it is the hotel property owners (franchisees) who are building the physical hotels.

Around 75% of operating profit is derived from the US, where Hilton has 14% of US hotel rooms. The rest of the profit is split between Europe (9% of earnings), Asia-Pacific (9%), Latin America (4%) and Middle East and Africa (3%). While it is still growing rooms at a healthy rate in the US, more than half the pipeline is outside of the US. As mentioned, in Asia-Pacific, for example, Hilton has a 2% market share of rooms, yet it accounts for about 24% of the region’s total hotel development pipeline (Hilton estimates). This has driven room growth of around 30% a year for the past few years in Asia-Pacific.

The company is trading at just below our fair value estimate of US$203 a share. If the future plays out as we expect, we believe an investment at the current price will deliver high single-digit total returns over time in US dollars. We’re comfortable paying fair value for this exceptional business, initiating a medium-sized position now and potentially building on this in the future.

Investors should note that there are likely to be ups and downs because sentiment around consumer spending does tend to impact the stock price of hotel companies in the short term. However, the company is relentlessly growing its system size over time, driving the intrinsic value higher for the patient long-term investor.

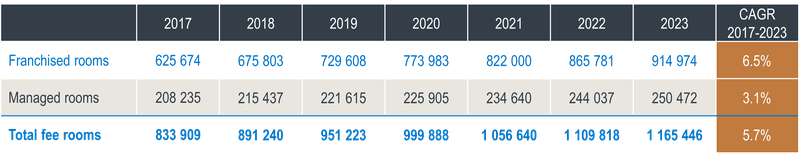

As can be seen in the table below, Hilton is a genuine growth business. It is this system-size growth that has driven earnings per share (Sanlam-adjusted) growth of 13.7% per annum over the past five years.

Free cash flows are returned to shareholders mainly though buybacks, with a dividend as well. If all progresses as we expect, Hilton should generate mid-to-high single-digit revenue growth, with growth in operating earnings of at least 10% a year. Share buybacks should then push earnings and free cash flows growth per share higher than 10% over time.

When formulating your investment strategy, we focus on your specific needs, life stage and risk appetite.

Greg Stothart has spent 16 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.