Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

How to build a

robust portfolio

Investment managers often construct their clients’ portfolios with a dominant macro view – and associated expectations of the future – dictating their decisions. In today’s uncertain investment environment, however, we believe it’s impossible to forecast outcomes with any degree of conviction. It’s therefore crucial that – guided first and foremost by valuation – portfolios are crafted for robustness and resilience across multiple scenarios.

‘Events such as the 9/11 attacks, 2009 global financial crisis, Arab Spring, Brexit, and election of Donald Trump continue to prove that traditional forecasting methods leave decision-makers dangerously exposed to unanticipated events.’

These are the words of Frans Cronje of the South African Institute of Race Relations, and we couldn’t agree more. Decision-makers, including investment managers, who claim they can forecast with conviction in today’s uncertain macro environment are, to put it bluntly, either very brave or very stupid. But this, unfortunately, is what many are still doing – crafting both equity-only and multi-asset client portfolios guided by a particular macro ‘story’ or outlook and associated expected outcomes.

When you position a portfolio based on one-dimensional future expectations, you may of course get it right and achieve excessive investment returns. However, you can also get it horribly wrong. And the pendulum may have a very short swing – a case in point is the outcome of the recent ANC leadership election, in which Cyril Ramaphosa pipped Nkosazana Dlamini-Zuma to the post by an extremely tight margin. It was a close call from the start, but people were prepared to ‘invest’ with conviction based on their view of who would win. The outcome being binary, however, they could just as easily have got it wrong.

At Sanlam Private Wealth, we take a different approach to constructing our clients’ portfolios. Our investment methodology first involves a bottom-up process, where each asset is assessed on individual merit. This is based largely on expected return – a function of both the value as well as the ‘story’ associated with the company in question.

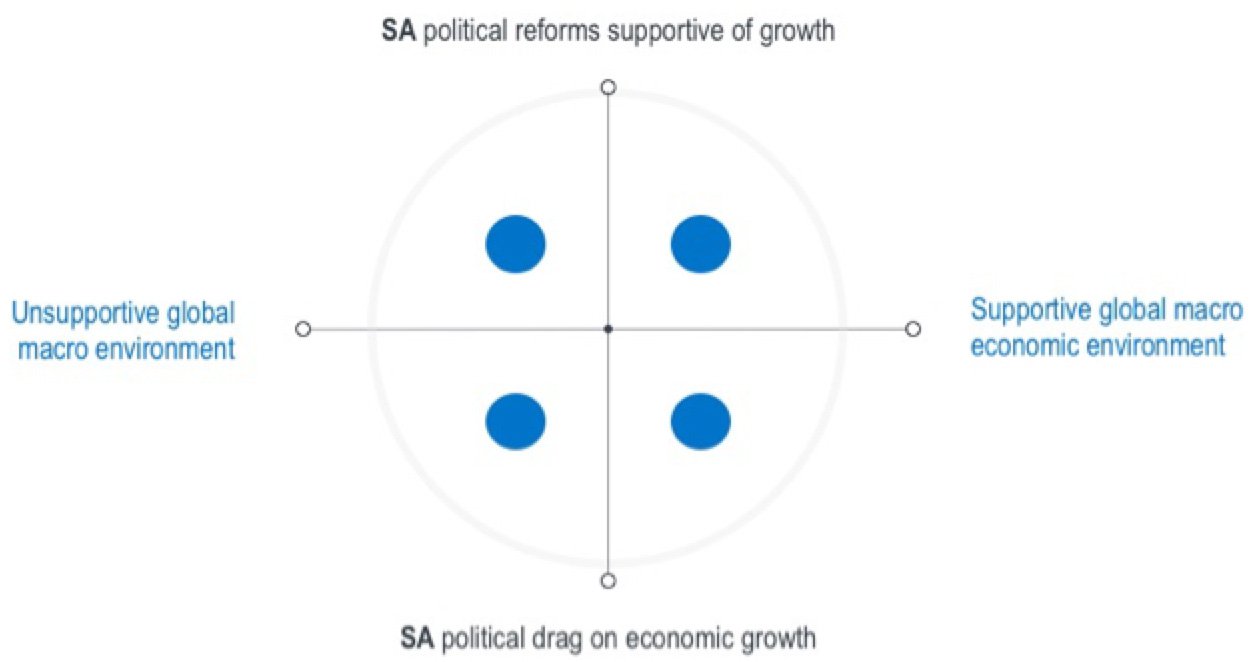

From a macro perspective, we divide the investment landscape into four quadrants, each defined by a combination of particular global and local economic cycles – the local cycles often dominated by the prevailing level of political certainty:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Different asset classes and even equities will generally behave differently in each of the four scenarios or phases of the economic cycle. In the bottom left quadrant, both local and global economic activity is under pressure – shares that tend to perform well here are defensive in nature and from a South African perspective, they are rand hedges, such as liquor and tobacco shares (economic cycles don’t appear to have an impact on whether or not people smoke). Where the global environment is supportive, but there’s uncertainty in the local economy (bottom right), commodity prices are likely to appreciate and our mining shares tend to do well.

If both the global and South African stories are positive (top right), cyclical shares are likely to outperform. Apart from the usual suspects, one would expect banks and even construction counters to do well here. In the top left quadrant, it’s clear that the focus should be on local exposure – domestic defensive shares that will benefit from local economic growth.

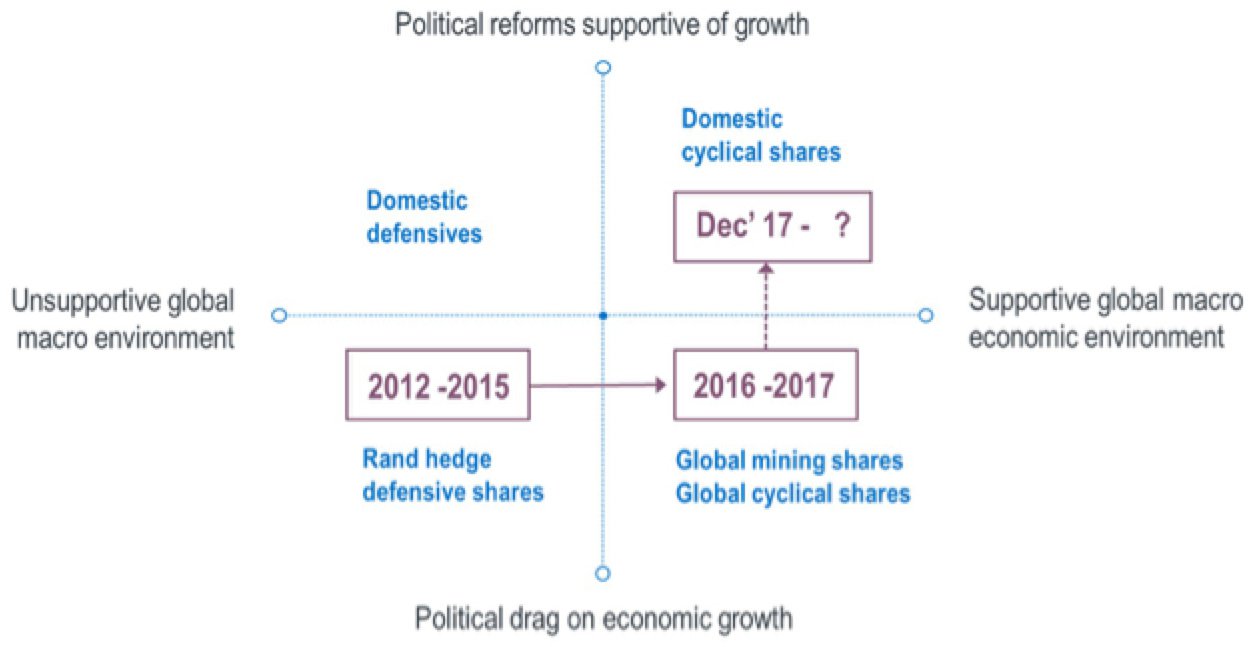

It’s important to note that there’s normally a logical, sequential flow between the four quadrants. The diagram below shows the current position of our investment environment:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

From 2012 to 2015, we had a rather pedestrian recovery in global economic growth, but from 2016 to 2017, it shifted gear to a synchronised recovery. Investors were still highly uncertain about local prospects, however, and our growth rate reflected this. In 2018, we should start seeing an uplift in the South African economy. So while we’re currently still mainly in the bottom right quadrant, we could soon be moving to the top right scenario.

If we map the main shares in SPW’s house view equity portfolio on our four-scenario diagram, the picture looks like this:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

The tilt of the portfolio lies in the two right quadrants – to benefit mainly from global growth, but also from a potential recovery in the local economy.

There is one proviso to benefiting from investing according to an investment landscape model such as this: you have to be early. Since the market tends to lag, it’s crucial to find the right assets before the cycle moves into the quadrant with which they’re associated. The cycle will then of course continue and the focus will shift to other shares that will benefit from the particular macro overlay at that time.

The implication of this is of course active asset management, taking profits when the good news is already reflected in the share price, and looking for assets whose price doesn’t yet reflect their potentially better prospects. So despite the fact that a particular share may be in the ‘correct’ quadrant at a certain time, it may already be priced in for that environment. If it becomes too popular or expensive, we’ll sell off and move to shares in the next quadrant if we know the cycle is changing.

On the other hand, when the cycle migrates, some of the assets in the ‘original’ quadrant may suddenly become very cheap. In this case, we’ll be guided by valuation as well as cycle shifts in deciding whether to pursue these opportunities.

Despite the fact that economic and market cycles may be ‘normal’, and many assume it’s easy to forecast the sequence of events, it’s not quite so simple. First, although events are more often than not sequential, the time spent in each phase will vary from cycle to cycle. In short, although the quadrant model is a handy tool, it does have shortcomings in terms of timing – deciding when to amend a portfolio. Second, we know that human intervention in the financial cycle always opens it up for surprises and of course, shocks. For these reasons we warn against a one-dimensional strategy.

At SPW we’ll always construct portfolios to be robust and resilient across multiple scenarios. While we tend to have a bias in a particular quadrant, our clients’ portfolios will also contain shares in the other quadrants. Besides the price considerations mentioned above, this is to ensure balance, and importantly, to reduce exposure to risk for our clients.

Diversification across the various scenarios is in our view the most effective way of ensuring our clients’ portfolios outperform over time – an approach that has borne fruit over the past 10 years. It will remain part of our tried and tested investment philosophy and process in protecting and growing our clients’ wealth.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Your wealth plan is designed with you in mind. Your financial reality, aspirations and risk profile.

Carl Schoeman has spent 22 years in Investment Management.

Have a question for Carl?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.