Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Investing in classic cars

gets into top gear

As an alternative asset class, classic cars have stolen the spotlight over the past decade. With a 1962 Ferrari 250 GTO selling for a record US$48.4 million at this year’s RM Sotheby’s Monterey auction in California – total sales came to US$158 million – it’s clear that investing in classic cars can be highly rewarding. This was also the view of enthusiasts at the recent 2018 Value in the Classic Car Market (VCCM) Historic Automobile Group International (HAGI) conference held in Sandton, which I was fortunate enough to attend.

What stood in front of me was an original product straight out of Zuffenhausen, Germany – the beautiful 1958 Porsche 356 A 1600 ‘Super’ Speedster. In the 1950s this vehicle cost roughly US$4 250. Today, auction prices are around US$350 000. Considering the unbelievable prices these great classic racing cars are fetching, one can understand why I was eagerly anticipating hearing more about investing in classic cars, and sharing stories with like-minded individuals over the next few days.

The VCCM HAGI conference brought together individuals who are first and foremost passionate about rare and collectable classic cars. They’re also investors, however, who see a place for alternative luxury assets in their portfolio. Iconic vehicles were discussed and analysed in the finest of detail, as were other rare and collectable assets such as art, photography and even whisky.

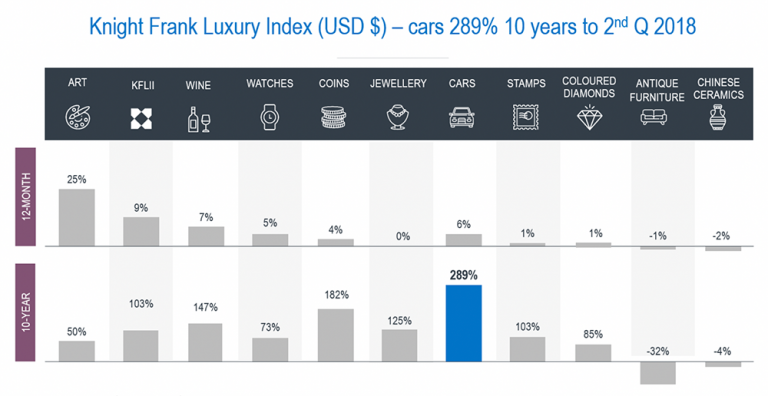

Within the broader luxury goods investment sector, classic cars stand out as a clear winner over the long term. Gaining 289% in US dollar terms over the past decade, they’ve remained firmly at the top of the Knight Frank Luxury Investment Index, as can be seen on the table below. The data is obtained from HAGI, the worldwide authority in this field, which has been tracking classic and rare cars through various auctions over the past few decades.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

One of the presenters at the VCCM HAGI conference talked about ‘synaesthesia’ – the production of a sense impression relating to one sense by stimulation of another sense. He identified synaesthesia as a reaction common to all collectors, including those who love vintage, collectable or super cars. The more I thought about this idea, the more it resonated with me.

Cars aren’t the only assets that can ignite synaesthesia – photography and art would most certainly have the same effect. How else can one explain the nostalgic feelings these assets impart to their owners? Or why they place so much value on them, especially when the most pristine and high-end specimens are often extremely rare and difficult to acquire?

The world’s markets are to a large extent driven by supply and demand. World Bank reports indicate that global wealth continues to rise, which means the demand for luxury goods is also increasing. Are luxury goods a defensive sector? It’s a good question. To my mind they are – most certainly if one considers the best in class. No matter the asset class, an item will demand a higher price if it’s original, rare, in good condition, and has excellent provenance.

Of course, as is the case in the retail sector, brand is crucial. One marque which stands out far above any other when it comes to collectable status is Ferrari. To date, 59% of the classic cars sold at auctions for more than US$5 million have been Ferraris.

I should mention here that calling the purchase of a vintage vehicle an ‘investment of passion’ may be something of a misnomer. Many of the collectors I’ve spoken to still own their most valued investment vehicles, or artworks, and will most probably never sell them. To my mind, you shouldn’t be aiming to buy a collectable car to sell it for a higher price in the future – you should be more concerned about whether the vehicle will hold its value into the future. The added benefit is that you’ll be able to experience the pleasure – and synaesthesia – of either looking at it, driving it, or simply smelling the petrol fumes.

What are the possible fiduciary and tax implications of investing in luxury items such as classic cars?

Stanley Broun of Sanlam Private Wealth’s fiduciary and tax team sheds light on the matter:

Taxes and duties

The tax rules for collectable items can be complex, and sound planning to minimise future burdens may be critical to the preservation of a collection’s value over the long term. For example, how these items are handled when the owner dies or sells them could have unintended tax consequences.

Certain collectable items (assets) used mainly for purposes other than carrying on a trade by a natural person or special trust will be considered a personal use item and won’t attract capital gains tax (CGT). If the collectable items are held within a company or trust and disposed of, the disposal will attract CGT or income tax, depending on whether the items were held in a capital account or a trading account.

Although as a ‘natural person’ you won’t pay CGT on a collectable item, you’ll still be subject to estate duty on its market value when you die. Some collectable items can increase significantly in value over years, so it’s important that you value the item(s) on a regular basis to ensure there’ll be enough liquidity in the estate to cover possible estate duty at death.

If there isn’t enough liquidity available, the appointed executor may have to dispose of some items in the estate in order to create liquidity. This in effect means your collectable, which you may have obtained with the intention of preserving it for future generations, might be among the items that must be disposed of.

Last will and testament

Your last will and testament is one of the most important documents you can sign, in which you record how and to whom you want your assets to be transferred after you die. Some collectable items, including paintings, can be transferred to a trust at the date of death, or to a surviving spouse or descendants. This transfer might trigger estate duty for the first generation, but also for the second generation upon their death, depending on the value of the item and how they handle it in their last will and testament.

Collectable items can be preserved, protected and looked after for generations to come within a trust. With the increase in estate duty and proposals made to Treasury regarding limitations on donations between spouses, it’s important that you consider how to structure and handle these items to ensure their preservation for future generations.

If you need any assistance with the above, please contact a fiduciary and tax specialist at Sanlam Private Wealth at fiduciary@privatewealth.sanlam.co.za.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We provide daily reporting of trades, monthly portfolio evaluations and annual tax reports to clients.

Riaan Gerber has spent 16 years in Investment Management.

Have a question for Riaan?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.