Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

‘Junk’ status for SA:

it’s not yet a done deal

Will they or won’t they? As the local market holds its breath for the next round of sovereign credit rating reviews by the world’s major rating agencies in December, this is the question that has been uppermost in the minds of investors for some time now. Earlier this year, most economists agreed that a fall to ‘junk’ status seemed inevitable. However, there is now increasing optimism that we may yet be able to dodge the downgrade bullet.

Since we last wrote about this contentious subject in May this year, both Moody’s and S&P have kept their credit ratings on South Africa’s government debt unchanged, although both ratings reflect a negative outlook, indicating the risk of a future downgrade.

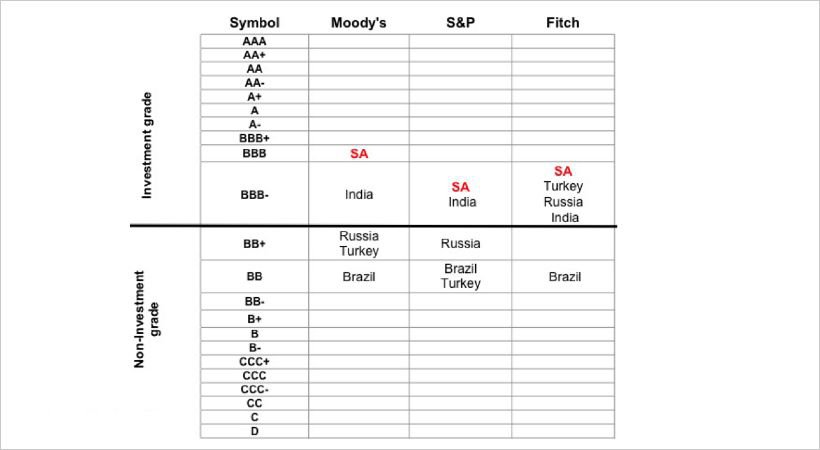

Compared to certain other emerging markets, our current position is as follows:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

As we’ve said before, it’s hard to find any positive outcomes for our economy in the event of a downgrade. But looking at our financial markets, it may not have much impact, provided that it was expected and accounted for in asset prices. If one looks at how the markets of countries that have lost their investment grade rating in recent years performed before and after becoming ‘junk’, it’s clear that in general, the currency, equity prices, budget and current account deficits deteriorated in the run-up to being downgraded, but then stabilised and often improved after the event. The muted reaction of the markets after the downgrades was a result of asset prices having moved ahead of the event.

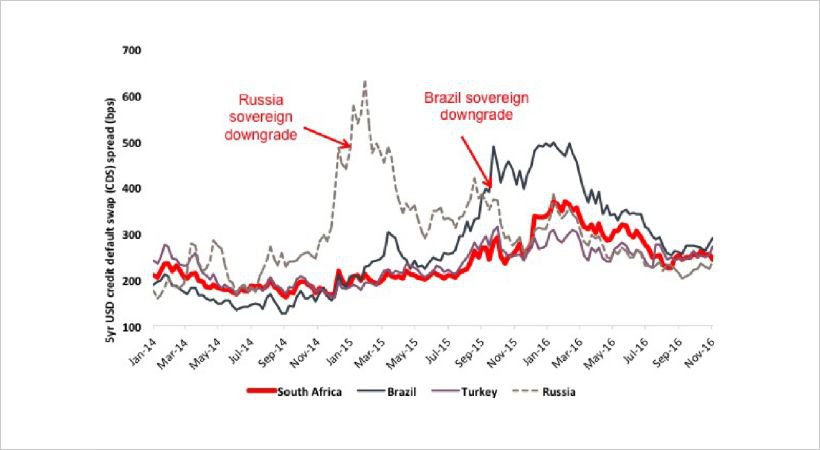

The most direct impact of a lower credit rating would be seen in the cost of South Africa’s foreign-denominated debt. The chart below shows a comparison of the cost to insure certain governments’ foreign currency debt against default. It’s noteworthy that South Africa is already priced in line with other countries that are rated ‘junk’ by one or more rating agencies.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

It’s also important to distinguish between the credit ratings of local versus foreign currency debt. Our government’s rand-denominated debt is rated higher than its foreign currency debt and therefore has a lower chance of losing its investment-grade status. The rand debt rating is also more relevant, as only 10% of government debt is denominated in foreign currency.

Although turmoil and uncertainty on the political front may yet prove to be the final decider for the rating agencies, many industry players and observers now believe the feared downgrade at the end of the year is not yet a done deal. Remember, it is about judging South Africa’s creditworthiness. The stabilisation of commodity prices during 2016 has led to increased optimism, as has the expectation that we may now be nearing the end of the drought. The recovery of the rand has also played a significant role in the outlook for inflation and interest rates. On balance, these events have all contributed to marginally better growth prospects and an improved ability to service debt.

We’ve had peaceful municipal elections with a shift in power towards the opposition, and recent ‘victories’ for the offices of the Public Protector and our Finance Minister have confirmed the strength of some of our institutions. Furthermore, initiatives towards better cooperation between government, labour and business to avert a downgrade have certainly counted in our favour.

From people talking around the braai to media reports, there’s much speculation that the rating decision will hinge on political events, such as the student protests or whether President Jacob Zuma stays or goes. However, the rating agencies predominantly base their decisions on the numbers, with particular emphasis on South Africa’s longer term economic growth outlook, and whether they’re confident that our government will manage the country’s finances prudently. The credibility of our Finance Minister and his Treasury plays a crucial role.

Rating agencies have been sympathetic towards South Africa’s current lack of economic growth, influenced by weak external demand, which has had an impact on exports, as well as the drought, which they see as temporary. The expectation is that economic growth will start recovering into 2017 as these headwinds dissipate. Other positives include the more reliable electricity supply, which had previously hampered growth, as well as an improved outlook for inflation following the recovery of the rand, and prospects for lower food prices, which may open the door for interest rate cuts next year.

The major rating agencies still assess South Africa’s institutional strength as high, and it is in this arena where political instability has the potential of accelerating a downgrade decision. If we can avert this, then the next step to retaining our investment-grade rating is to prove that we can reignite longer term economic growth by introducing the necessary structural economic reforms that will make South Africa a more business-friendly environment. The imminent threat of a downgrade has provided the impetus for better cooperation between government, business and labour, but it remains to be seen whether policymakers will eventually push through the necessary reforms in the future given the various vested interests and social demands.

Despite the threat of a downgrade, we increased exposure to banks in many of our client portfolios as well as to government bonds in our asset allocation portfolios earlier this year. Our reasoning was based on valuation and our view that the market had already priced in the downgrade at the time – almost a case of ‘heads I win, tails we draw’.

Both of these investments have performed well since, but the good performance wasn’t so much driven by investors’ view on whether we would be able to avert a downgrade as was it by the improved investor sentiment towards South Africa’s emerging market peer group, driven by a recovery in commodity prices and the delay in interest rate hikes by the US Federal Reserve.

South Africa’s dollar-denominated debt is still trading in line with the likes of Russia, Turkey and Brazil, which are already rated non-investment grade by S&P. The market doesn’t seem to distinguish us from the others simply because of our current better credit rating.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We can help you maximise your returns through an integrated investment plan tailor-made for you.

Niel Laubscher has spent 10 years in Investment Management.

Have a question for Niel?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.