Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

LOADSHEDDING: IMPACT

ON YOUR PORTFOLIO

Recent company results have started to expose in numerical terms what most investors have understood but struggled to quantify: loadshedding is having a significant impact on the profits of companies with South African operations. Armed with improved information provided by these businesses, we examine the implications for our clients’ portfolios.

First, it’s important to note that a major proportion of the value in JSE-listed companies lies in operations outside South Africa. There are multiple ways to slice and dice the available data, but our analysis suggests that ~54% of the value of the FTSE/JSE All Share Index (our benchmark for South African-focused portfolios) is outside the country, while around 41% of the value of the FTSE/JSE Shareholder Weighted All Share Index (SWIX – the benchmark for many of our peers) lies beyond our borders.

Second, we remind readers that most of our mandates at Sanlam Private Wealth hold a proportion of offshore assets. So these portfolios are obviously less impacted by loadshedding. For the purposes of this article, we’ll focus on the local market, but for most of our clients, the numbers highlighted below can be downscaled by the proportion of assets held outside South Africa.

How has loadshedding impacted local businesses? Although it has become materially worse over the past six months or so, the concept has been with us for a number of years and businesses have adapted to be able to handle occasional power cuts to some extent. So with the increase in the intensity of loadshedding over the past few months, companies have generally been able to make a plan. The problem is that the higher levels of loadshedding translate into increased costs.

Loadshedding affects the companies listed on the JSE in a number of ways. The most direct impact is typically felt by businesses that require electricity for the creation of products, including manufacturers, miners and telecom operators. If their operations are disrupted by loadshedding, these businesses will have less product to sell. Miners usually have agreements with Eskom for load curtailment rather than loadshedding, but they are also affected, particularly in the area of platinum smelting.

Larger manufacturers are typically located at national key points, where they are immune from loadshedding, but this isn’t always the case for smaller players. Cell phone operators, which have thousands of towers all over the country, don’t have the same protection and must rely on a combination of batteries and diesel generation. In general, capital-intensive businesses like these have wider profit margins, so the incremental costs don’t impact a particularly large proportion of profits.

The next group of businesses that suffer are retailers. While these companies don’t make their own products, they need electricity to be able to sell them. Food and grocery retailers need electricity not only to keep the lights on and the credit card machines working, but the fridges and bakeries also consume a lot of power.

Grocers typically have thin margins. Shoprite, the most profitable of the South African grocers, had an operating profit margin after leases of only 4.3% in the year to June 2022. So the additional impact of running generators hurts. Shoprite’s six-month results to December 2022 indicated the trading margin had fallen despite excellent revenue growth.

Finally, service businesses experience the least pain. While it costs a lot to keep offices illuminated, this expenditure is relatively small compared to the ‘people’ costs of running a bank or insurer.

Businesses with customers within South Africa will also feel the pain of slower local economic growth resulting from the impact of loadshedding on the wider economy. This means we can expect slightly lower growth over the coming years than would have been the case without the high levels of loadshedding.

Investors should also be aware of loadshedding’s implications for capital allocation. All the management teams of companies impacted by loadshedding that we’ve spoken to are looking at options to generate more of their own power. The telecom companies, for example, are spending billions of rands on batteries and generators for their towers. Many businesses are installing solar panels on rooftops, while several miners are involved in larger-scale solar projects. However, spending this capital on solving electricity problems means less is available for other growth initiatives.

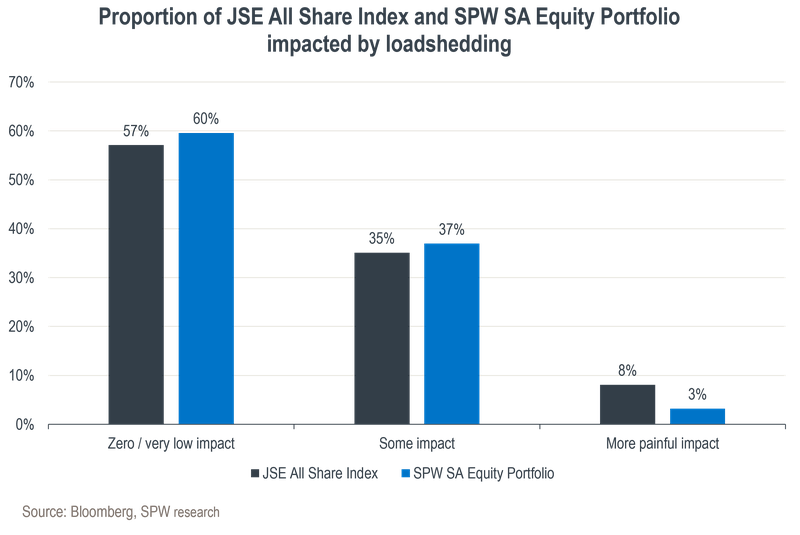

What are the implications for our clients’ investment portfolios? The graph below illustrates the exposure to loadshedding within Sanlam Private Wealth’s South African equity portfolio compared to the wider local market. The ‘zero/low impact’ block includes companies like Richemont, Naspers, Bidcorp, British American Tobacco and BHP, where most of the value sits offshore. In the second group we find companies such as FirstRand, MTN, Sanlam, Bidvest and Pepkor that are impacted by the slower general economy, but whose direct costs are not too painful in the context of overall profits. The third batch contains businesses where the impact is most keenly felt, like the platinum miners, Pick n Pay, Vodacom and Tiger Brands.

As the chart shows, Sanlam Private Wealth’s South African equity portfolio has a greater proportion of its holdings in businesses with zero or very low impact from loadshedding, and most importantly, materially less exposure to those businesses where the impact is most painful. Our client portfolios are thus relatively less affected by loadshedding than the wider market.

While the above analysis shows which businesses are affected more than others, it doesn’t show how much of the good or bad news has already been baked into prices. It should be remembered that the price one pays for an asset is a key determinant of whether that asset delivers market-beating returns or not.

We believe our current portfolio positioning has protected our clients from the worst impacts of loadshedding. However, we remain vigilant for opportunities where the market might be pricing in a worse scenario than what actually plays out.

When formulating your investment strategy, we focus on your specific needs, life stage and risk appetite.

Greg Stothart has spent 16 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.