Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Mini-Budget 2019:

A disturbing fiscal picture

Reaction to Finance Minister Tito Mboweni’s much-anticipated second Medium-Term Budget Policy Statement (MTBPS) last week has been mixed. While drawing praise for his straight talk, the Minister came under fire for the dearth of solutions in his presentation. He certainly pulled no punches in painting a decidedly gloomy fiscal picture. We were disappointed, however, that he failed to reveal any clear action plan to address the three most crucial issues crippling our economy: fiscal slippage, state expenditure and debt stabilisation.

It was with a wry smile that I read former DA leader Tony Leon’s observation in Business Day in which he stated that ‘this Medium-Term Budget Policy Statement (MTBPS) is the grimmest and most difficult in a generation’. If I consider our views after the Budget Speech in February, I’m not sure much has changed since then. We noted that all the important fiscal ratios were pointing in the wrong direction, while at the same time, ordinary South Africans were urgently demanding improved service delivery. The local economy was struggling to grow at a rate faster than consumer inflation, the Eskom debacle was tangible, and the numbers were frightening.

Finance Minister Tito Mboweni thus had to present his first Budget Speech to Parliament in a challenging economic and political environment. Leading up to the event, we all speculated whether he would be brave enough to address the obvious overspending on government consumption to reduce expenditure in relation to gross domestic product (GDP) that would ultimately stabilise government debt levels in 2023/24. Our conclusion was that while the narrative looked promising, the numbers remained deeply concerning – and the margin of error too small for comfort.

As the year unfolded it became obvious that our scepticism was not unfounded. Hence, Tony Leon’s observation. The Minister, quite frankly, still faces exactly the same challenges that he did in February. The only difference is that he now has more realistic numbers to work with in the fiscal prudence balancing act – with no economic tailwinds from an income perspective.

Most importantly, the MTBPS is another policy intervention in which the Minister had to show his hand on the likely fiscal and economic paths of the Ramaphosa administration. The market is looking for guidance or information in the following areas:

Our initial response regarding these three areas is one of disappointment.

The immediate revenue shortfall and spending cuts, as well as the FY19/20 main budget deficit (6.2% of GDP) match our own, as well as market forecasts.

However, the medium-term fiscal projections have worsened materially and also relative to expectations, as Treasury has effectively made politicians responsible for negotiating the significant interventions required to achieve its proposed new fiscal target of a main budget primary balance (revenues equal to non-interest spending, excluding Eskom support) by FY22/23. The main budget deficit is forecast to widen to 6.8% of GDP in FY20/21 from the new 6.2%.

We fully acknowledge that politicians can hardly claim historic success when it comes to expenditure challenges.

As stated above, we expected the Minister to be realistic about income, since measures to boost it over the short term are rather limited. Tax revenues are projected to be a disappointing R52.5bn less than the 2019 Budget estimates in FY19/20 and R84bn in FY20/21. The FY20/21 forecasts are more conservative than ours, which would suggest an extreme soberness on the part of the Minister.

This shortfall implies that the Minister has had his work cut out on the expenditure side to address the shortfall. However, for FY20/21, the main budget non-interest spending still increases by R23bn owing to the additional injections for Eskom (announced after the 2019 Budget), but spending is now projected to be R8.2bn lower in the following year. In FY22/23, spending will grow in line with consumer inflation, in other words, there will not be real spending growth.

The focus of these savings efforts is on improving efficiency and reducing wasteful expenditure, while government claims it will:

Proposals to consider in reducing the government wage bill include pegging the cost-of-living adjustments at or below consumer price index (CPI) inflation, halting automatic pay progression and reviewing occupation-specific dispensation for wages. Progress after discussions with labour will be announced in the 2020 Budget. These are hardly proposals that will move the so-called needle.

A major disappointment was the absence of a detailed financial strategy for Eskom, and other financially troubled SOEs. ‘Some debt relief will be provided to Eskom over time, as operational and financial performance improves,’ the Minister stated. Cost reductions and progress with the unbundling process are two of the prerequisites for any such considerations. This debt-relief process will be managed to ensure ‘any default and cross-default on total Eskom debt is contained’ and creditors ‘are treated equitably’. Most operational changes are expected to be implemented before the end of 2021.

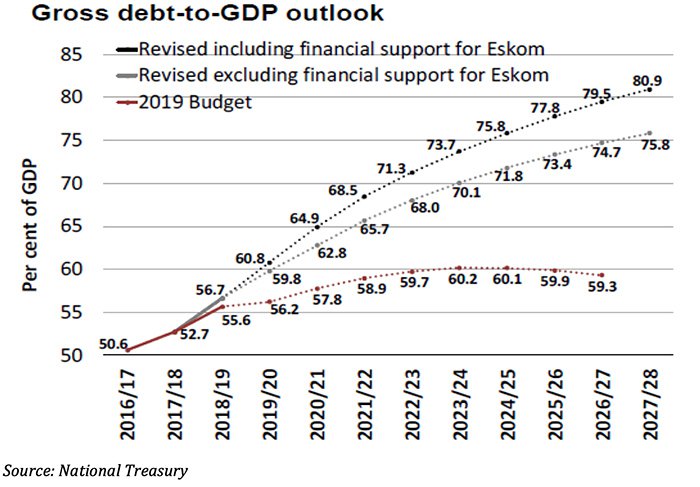

The biggest disappointment and shock was the revised gross debt-to-GDP path projections:

Total gross loan debt is budgeted to rise to a revised 60.8% of GDP in 2019/20, much higher than the 56.2% forecast in the February 2019 Budget Speech, and to continue rising to 71.3% in 2022/23. Even excluding Eskom bailouts, the figures are unflattering, with a move to 68% over the period. Financing will remain mainly longer term and sourced in domestic markets.

Financial markets responded aggressively to the lack of detail in terms of expenditure intervention and the financial strategy regarding Eskom, as well as fundamentally different projections of the medium-term debt-to-GDP. The rand fell sharply from its opening levels of R14.62/US$ to R15.02/US$, and the yield on the R186 – the seven-year government bond – sold off from 8.21% to 8.42%.

Investors are obviously concerned about the medium-term funding implications of the increased debt levels and the view rating agencies are likely to take on the mentioned concerns. When Treasury previously published an MTBPS that set out the unsustainable fiscal path that South Africa would travel in the absence of decisive intervention to change course, S&P downgraded South Africa’s sovereign ratings while Moody’s placed our country’s rating on review. Last week, despite the bleak reality confirmed by the MTBPS, Moody’s again spared us a sovereign credit rating downgrade to non-investment grade – which would have resulted in the exclusion of South African government bonds from global bond indices, triggering forced selling of our bonds.

Moody’s did, however, change the rating outlook from stable to negative, implying a material risk that the rating may be revised downwards in the near future. The agency has noted that the rating may be downgraded if further economic and financial evidence suggests government won’t be able to implement its fiscal and economic strategy to halt and ultimately reverse the debt trajectory. In particular, the February 2020 Budget will be a key indication for Moody’s on whether the government is committed to fiscal consolidation.

The equity markets’ response to the MTBPS was quite predictable given the slide of the rand. Rand hedge shares responded positively while the SA Inc complex, like the banks and retailers, came under pressure after a recent bounce in these prices. If we witness a continuation of extreme price movements of individual counters, it may well trigger action in our portfolios – we will sell expensive shares and buy shares that are unfairly penalised.

A final note: It was indeed a difficult speech to deliver. Our observation is that the Minister painted an extremely sober fiscal picture, but with clear political constraints hampering brave fiscal reform. Maybe this was his way to get his urgent message across to his co-Parliamentarians:

‘Now is the time. We cannot wait any longer. If we want a successful harvest, we must act today.’

We trust there will be more evidence of political will to intervene to get South Africa back on a sustainable fiscal path when the Minister delivers his main Budget Speech in February 2020.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Your wealth plan is designed with you in mind. Your financial reality, aspirations and risk profile.

Carl Schoeman has spent 22 years in Investment Management.

Have a question for Carl?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.