Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

OIL: STARING DOWN

THE BARREL?

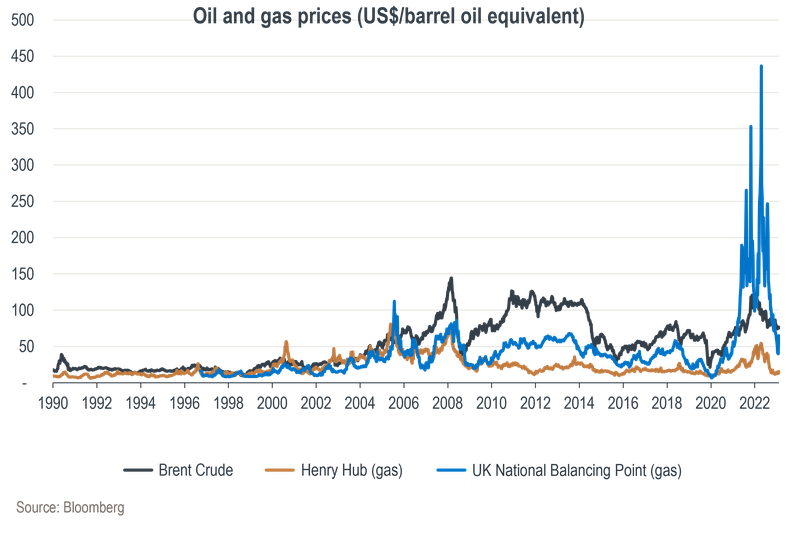

Oil and gas prices rose dramatically in the wake of Russia’s invasion of Ukraine last year, with Brent crude oil reaching US$130 per barrel while European gas prices shot to above US$400 per barrel at the height of the energy crisis. Prices have since corrected significantly, however. With many factors currently impacting the state of play in the industry, what is the medium-term outlook for global oil markets? Are they still an attractive investment opportunity, or has the narrative changed? And what about the oil companies themselves?

We’ve been arguing for a while now that the lack of new investments in the oil industry over the past number of years – in the context of still resilient and growing demand predicted for at least the next decade – would lead to higher prices.

This view certainly played out last year in the wake of Russia’s invasion of Ukraine and the resulting energy crisis. Brent crude oil prices rose dramatically to US$130 per barrel while natural gas prices in the US (as measured by the Henry Hub benchmark price) rose to above US$50 per barrel on an oil-equivalent basis. In Europe, gas prices topped a staggering US$400 per barrel on an oil-equivalent basis at the height of the crisis. See for example the UK’s National Balancing Point gas price on the graph below:

Prices have since corrected, with oil now back below US$80 per barrel and European gas prices down to well below those of oil (on a barrel-of-oil equivalent basis) after Europe experienced a warmer-than-expected winter, leading to excess gas in storage.

Other notable reasons for the decline in energy prices were much softer global demand and more resilient supply (both from Russia and the rest of the world) than was expected at this time last year. This was partly offset by recovering demand from China (10-15% of global demand) after this country abandoned its zero-Covid-19 policy, as well as increasing aviation levels, which are still trending back to normal (~8% of global demand) after being devastated by the pandemic travel restrictions.

Where does this leave the medium-term outlook for oil markets? Are they still an attractive investment opportunity, or has the narrative changed?

From a demand perspective, our base case remains unchanged – in our view, we’re still likely to see rising absolute levels of oil demand until at least the end of this decade and probably into the next. Emerging markets will continue to experience population growth, requiring more energy to fuel their economies. The World Bank has estimated that there will be roughly 9.7 billion people by 2050 compared to 8 billion today, with most of this growth taking place in India and Africa.

Alternative fuels (for electric and hydrogen vehicles) do pose a significant long-term threat to oil demand (passenger cars currently make up roughly 25% of all oil demand and commercial vehicles another 15%), and electric cars’ share of new vehicle sales is rapidly increasing. However, it will take time for these vehicles to penetrate the global car park of ~1.4 billion vehicles – most of which are still fitted with a petrol or diesel internal combustion engine.

Before and during the onset of the Russia-Ukraine war, we were quite concerned about the lack of new investment into oil and gas, particularly from the listed oil majors. Although it’s not our base case, we believed that there was a risk that prices may need to be substantially higher for a sustained period in order to incentivise more investment. The war prompted just this response, with many nations now acknowledging that energy security is, again, just as important as transitioning away from fossil fuels over time.

One need look no further than the integrated European oil majors, which, after briefly announcing sharp reductions in fossil fuel production levels by the end of the decade (for example, BP previously projected a 40% reduction by 2030), now have much lower decline rates. They are in fact ramping up capital expenditure in oil and gas until at least 2025. This does mean that the supercycle case for oil – where prices stay above US$100 per barrel for a sustained period – looks much less probable to us than it did before.

However, large, listed oil companies are much more disciplined today than they were a decade ago, with almost all of them prioritising return on capital (value) and energy transition above production volume or earnings growth in their long-term management incentive structures. This does mean that despite a resumption in capital spend on oil and gas, these investments are unlikely to get out of hand and will be approved only if they make sense at conservative oil and gas price assumptions. In addition, the industry faces natural production decline rates of about 5% per annum, meaning that 5% of production needs to be replaced yearly just to keep output flat.

Founded in 1960, the Organization of the Petroleum Export Countries (OPEC) remains the global cartel with the longest standing. After its dominance was briefly threatened by the rise of shale oil in the US, OPEC is again in a powerful position to control markets.

The technological breakthroughs to successfully extract oil from deep underground shales through fracking were remarkable – shale oil grew from nothing two decades ago to almost 10% of global output today. However, despite large remaining reserves, the ability to grow annual production is becoming more challenging due to both declining well productivity and the need to continuously replace old production operations. Unlike a traditional oil well, a shale well produces most of its oil in its first year of production and then experiences a sharp decline.

The result of this is that OPEC is back in the driving seat and now produces ~30% of global oil (~40% if Russia is included in the so-called OPEC+ group). It also has the ability to cut back on oil output in times of demand weakness to support prices without worrying too much about giving up long-term market share to the US.

This was demonstrated recently when OPEC announced a 1% cut in April as well as another voluntary 1% cut in July by its largest member, Saudi Arabia, which produces ~10% of global oil. Saudi Arabia has a budget break-even oil price level of between US$70 and US$80 per barrel – a level to keep a close eye on in order to understand its incentives.

We think there’s good reason for medium-term oil markets to remain well supported at these price levels, for all the reasons mentioned above. But if prices merely settle at these levels, are oil companies still attractive investments?

Despite the risk posed by the energy transition away from fossil fuels, we believe that oil companies can still be an attractive investment proposition over the medium term, especially with the increasing focus on shareholder returns at many of these firms, with debt now at very sustainable levels almost across the board. In addition, valuation levels are not very demanding.

At the time of writing, US oil majors Exxon and Chevron were trading at one-year forward free cash flow yields of ~9% after investing in oil and gas volume growth of ~2% per annum to the end of the decade. European integrated producers Total, Shell and BP were trading at more attractive levels of between 12% and 16%, albeit at flat to declining fossil fuel production levels, but offset by increased marketing and renewable energy production.

Locally listed chemical and synthetic fuels producer Sasol was trading at an even more attractive level of ~18%. For context, an 18% free cash flow yield, even when we assume no growth in free cash flow, means the entire market cap of the company can be returned to shareholders before the end of 2028 if current prices hold.

In summary, we remain conscious of further downside risk to near-term oil prices should the US go into recession. In addition, we don’t see an oil supercycle as the most likely outcome. However, we’re still constructive on the medium-term outlook for oil companies, as we believe they can generate market-beating returns without having to assume higher prices.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.