Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Old Mutual:

the big break-up

2018 is a significant year for two heavyweights in the financial services sector: Sanlam and Old Mutual. But whereas Sanlam is celebrating its centenary, Old Mutual – an even older company – will execute its so-called ‘managed separation’ project, which will lead to the closure of its UK head office and complete the reversal of its internationalisation strategy of the 2000s.

Two ships crossing the Atlantic receive notice of a mega-storm heading their way. One of the captains reacts with caution, reroutes and misses the storm by 200km, leading to an extra day’s travel time. The other captain decides to take his chances, holding his course until the last moment before diverting out of the storm’s way, missing it by 1km and saving his passengers a great deal of time.

Now imagine that rather than missing the storm by 1km, the speed of the storm catches the second captain by surprise. The ship breaks up in the storm, and for hours the captain manages to swim half the passengers to safety before drowning from exhaustion. Two days later all the newspapers sing the praises of this heroic captain, while nothing is ever written about the captain of the first ship that quietly sailed into port the previous evening. As a passenger, which captain would you have preferred?

In the investment world, great turnaround stories usually capture media attention and the people in charge who produce these turnarounds for investors are highly regarded. But in truth, the management teams we should appreciate even more are those who don’t necessarily make the headlines, but who don’t put their companies in a position where heroic turnarounds are later required.

We can draw an analogy from the story of the two captains to the different paths of two of South Africa’s top financial services companies – Sanlam and Old Mutual. Whereas Sanlam is celebrating its 100th year in business, Old Mutual, established in 1845, will this year complete its ‘managed separation’ process, including splitting into three separate businesses, and the winding down of its London head office.

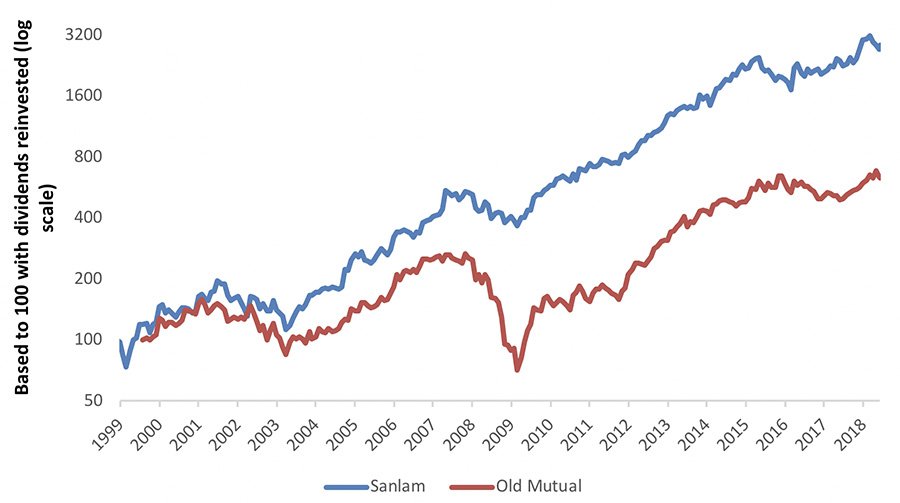

Both Sanlam (1998) and Old Mutual (1999) demutualised just before the turn of the century when ownership converted from policyholders to shareholders. But there’s been a material difference in the returns for Sanlam and Old Mutual shareholders since demutualisation. As can be seen on the following graph, with dividends reinvested, a R100 000 investment in Sanlam then would be worth R2.9 million today, while the same R100 000 invested in Old Mutual would now be valued at R633 000.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Most of Sanlam’s outperformance occurred between 2003 and 2009. Old Mutual led an aggressive strategy of international expansion at a time when the rand was weak and international markets expensive. Sanlam, on the other hand, focused more on its domestic market and expansion into the rest of Africa. The global financial crisis of 2008 and 2009 brought Old Mutual to the brink of bankruptcy when market losses in its US and Bermudan businesses threatened the survival of the rest of the group, which had guaranteed the debt. Old Mutual’s share price recovered well after the financial crisis, however, as markets normalised and it managed to dispose of a number of its international businesses.

Today, Old Mutual is a much simpler and more focused group compared to a decade ago. It consists of three business units:

All three businesses are in reasonably good shape, well capitalised and growing. However, the market price of Old Mutual has persistently traded below the sum of the fair values of these businesses.

There are a number of likely reasons for the discount in the share price:

Old Mutual’s managed separation will attempt to unlock this conglomerate discount by separating the three business units and putting each back in the hands of its shareholders. The company will also close down its UK head office, which will save costs. Another important consequence of separately listed businesses will be increased market scrutiny, which should better incentivise the respective management teams’ performances.

The timing of the managed separation seems fortuitous for Old Mutual shareholders, given the high ratings on which the closest in-country peer of each business unit is currently trading:

Old Mutual had to cut back on its dividend payment over the past two years in order to reduce debt and capitalise the individual business units in preparation for the separation. Following the recently announced disposals of a UK asset manager and the Latin American operations, the proceeds from the sale of 9.6% of Quilter to external investors and wind-down of the head office balance sheet, the individual businesses will likely find themselves with excess capital. We believe this will result in special dividends from both Quilter and Old Mutual Limited in the near future.

If we value Old Mutual Limited in line with Sanlam, and Quilter in line with St James Place, we can get to an illustrated fair value of up to R60 per Old Mutual share – well above the R40 at which Old Mutual is trading at the time of writing. Although we do believe some discount is warranted relative to Sanlam and St James Place when valuing Old Mutual and Quilter, the opportunity to unlock value remains attractive.

The separate listings of Quilter and Old Mutual Limited on the JSE are expected to take place on 25 and 26 of June, respectively. Current Old Mutual PLC shareholders will receive one Quilter PLC share and three Old Mutual Limited shares for every three Old Mutual PLC shares owned. In about six months’ time, there will be another distribution of around three Nedbank shares for every 100 Old Mutual Limited shares held at the time.

We bought Old Mutual at a time when investors were disillusioned by poor management decisions and the impact of those decisions on the company’s growth path. Since the purchase, the Old Mutual share price has actually outperformed that of Sanlam. Our patience with the shareholding is likely to provide further reward should logic prevail during the final stages of the unbundling process.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.