Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

On My Mind

– Trump: how did this happen?

‘I don’t want to sugarcoat anything. Nothing is easier, much will be difficult.’ The candid words of German Foreign Minister Frank-Walter Steinmeier the day after the shock election of Donald Trump as the next president of the United States echoed sentiments worldwide. Incredulity quickly turned to pragmatism however, as world leaders had to accept that the real-estate mogul from New York was now one of them. Even the Oracle of Omaha, billionaire investor Warren Buffett, called for ‘coalescence’ behind the President-elect. The message is clear – despite disappointment and uncertainty, we have to move forward in a positive way in a new global era likely to be rife with challenges but also exciting opportunities.

In our last ‘On My Mind’ column around a month ago, we cautioned that polls and predictions can be notoriously wrong, and that the unthinkable may yet become a reality in the US presidential election. And indeed it did. The Republican candidate’s victory is one of the biggest political upsets we’ve seen in a long time, and the world is still grappling with the soon-to-be reality of Trump at the helm in the White House. There will no doubt be much introspection going forward. The big question is, of course, how on earth did this happen?

As did the Brexiteers in the UK earlier in the year, the American people have made an unequivocal choice – against the establishment and the prevailing narratives, and for radical change. The overriding sentiment is that the ideals of liberalism and the story of globalisation over the past 20 years have benefited the wealthy, but the middle classes and the poor in the West have not shared in the spoils. Increasing inequality the world over and general discontent with austerity measures have spurred the rise of populist movements – not only in the US but also in growing separatist campaigns throughout Europe.

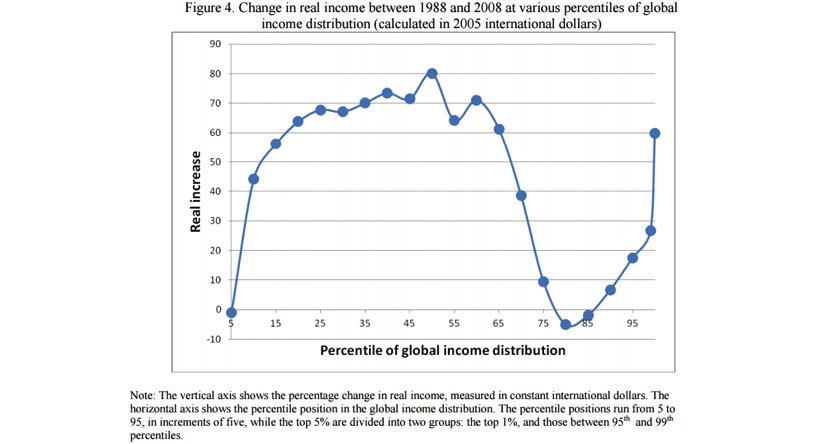

The trend has been captured in the by now well-known ‘elephant chart’ (see below) – so named due to its distinctive shape – devised in 2012 by World Bank economist Branko Milanovic. The chart shows the changes in global income distribution between 1998 and 2008. As Milanovic explained at the time, the global top 1% consists mainly of people from advanced economies, of whom half are Americans. The biggest losers of globalisation are those in the 80th to 85th percentile of the global income distribution, whose income gains over the period essentially amounted to zero. He called these people a ‘global upper-middle class’. Seven out of 10 people at this point are from the ‘old rich’ Organisation for Economic Co-operation and Development (OECD) countries.

Fertile ground indeed for a populist leader like Trump, whose successful harnessing of middle-class resentment may also encourage anti-globalists hoping for similar results in upcoming European elections, including the Italian constitutional referendum in December, and elections in France, the Netherlands and Germany next year.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

I believe we’re witnessing a backlash against the status quo, the likes of which we last saw during the Arab Spring in 2011 – with the difference that people are now demanding change not through popular uprising, but via the ballot box. The directive to Western governments is indisputable – if they want the ideals of liberalism and the benefits of globalisation to continue, they’ll have to radically rethink the way the income pie is currently being divided. The Trump win is a wake-up call for governments to take concerted action to ensure the frustrations of the middle and working classes are addressed. How this is to be effected will have to be the subject of some serious soul-searching by the powers that be over the months to come.

As our Director of Investments, Alwyn van der Merwe, pointed out in a note to investors last week, much depends on whether or not Trump’s populist policies (or proposals, to be more precise) are actually translated into meaningful action. US President Barack Obama said earlier this week that Trump would certainly face a ‘reality check’ if he attempts to implement his most extreme election promises once in the Oval Office. In addition to there being a vast difference between electioneering and the realities of public office, he will also have to get his policy agenda through both houses of Congress first, so nothing is likely to happen overnight.

What could lead to growth in the US and will therefore have a positive impact on the markets are his plans to stimulate the US economy through additional infrastructure spending, tax cuts and deregulation. His ambitious infrastructure plans will certainly be good news for commodity-producing countries such as South Africa and other emerging markets.

These potential positive impacts may well be derailed, however, should some of his isolationist and protectionist campaign rhetoric become policy. If he does interfere with existing trade arrangements such as the African Growth and Opportunity Act (Agoa), it may have far-reaching consequences for South Africa as well as the rest of Africa. We can only hope pragmatism will trump the severe populism of his election rhetoric.

There is unfortunately no crystal ball we can peer into, so what the longer term fall-out of Trump’s victory at the polls will be is anyone’s guess. We really are in uncharted territory, with the script being written as each day, or even hour, unfolds. What we do know is that we have a new leader of the free world. And we want to see him succeed in terms of pacifying the discontent that got him elected, while still reviving growth, and without excessive and damaging moves on international trade agreements.

In the face of uncertainty as to where the US President-elect’s emphasis will fall, a degree of market volatility and economic fragility is likely to remain with us for some time to come. The see-saw of events on a macro level is challenging to investors from an emotional perspective, to say the least – for example, Trump’s appointment of Steve Bannon, editor of ultra-conservative website Breitbart News, as his chief strategist, has already drawn strong criticism from various quarters.

As we mentioned at the series of client events we held across South Africa recently, the ‘noise’ around a macro event such as the election of Trump is often highly testing for investors. It’s important to remember, however, that times like these can provide good long-term investment opportunities. We’ll of course be keeping a close watch on unfolding events while remaining committed to our long-term investment philosophy and process.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.