Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

OUR FRAGILE CURRENCY:

CAN THE RAND BOUNCE BACK?

The rand has weakened severely over the past two years, losing more than 40% of its value against the US dollar since June 2021 – earlier this week, our beleaguered currency plunged to a new record low. Historically, the rand has always managed to recover from points of extreme pessimism, but with so much risk currently associated with South Africa, can we realistically expect this pattern to repeat? How does this impact long-term investment decisions?

Media commentators tend to attribute the movement of the rand to the political headlines of the day, but it’s important to distinguish between external global macro-economic drivers and South Africa-specific factors when assessing our fragile currency’s performance.

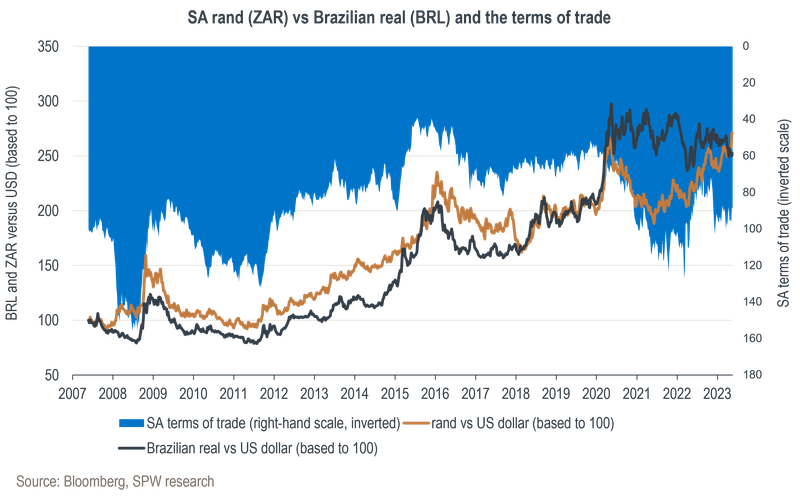

A simple way to determine whether external or internal factors are at play is by comparing the rand’s movement to comparable emerging market currencies such as the Brazilian real, as seen in the chart below. We can also compare it to South Africa’s terms of trade (a measure that shows the movement in the relative prices of our country’s imports and exports, which correlate strongly with mining commodity prices).

We can see here how important commodity prices are for the currencies of countries such as South Africa and Brazil. Both currencies are also impacted by global risk events, such as the global financial crisis in 2008/09 and the Covid-19 pandemic in 2020 when emerging market currencies were generally shunned in favour of perceived safe havens such as the US dollar.

When these two currencies start to diverge, however, it’s usually a sign that domestic factors have come into play. For example, the ‘Ramaphoria rally’ in early 2018 resulted in abnormal rand strength, while Brazil clearly missed out on some of the post-pandemic recovery due to internal political issues. More recently, as loadshedding has intensified in South Africa since late 2022, the rand has noticeably started to underperform both its emerging market peers and the US dollar.

South Africa can only blame itself for its recent currency woes. The negative impact of severe loadshedding on economic growth and investor confidence is the direct result of the long-term mismanagement of the state-owned power utility. South Africa’s greylisting by the Financial Action Task Force in February, and the public relations fallout resulting from our perceived association with Russia, are also self-inflicted wounds.

Historically, the rand has always managed to recover from points of extreme pessimism. However, given the number and extent of South Africa’s ‘own goals’, is it realistic to expect that the pattern will repeat?

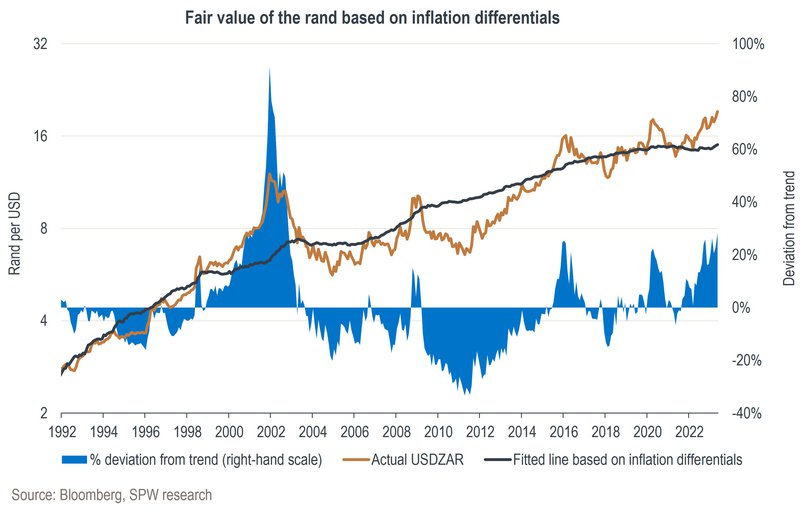

The ‘fair value’ of a currency is ultimately determined by its relative purchasing power. The chart below shows a regression of the change in purchasing power (i.e., inflation differentials) versus the prevailing rand/US dollar exchange rate over the past 30 years. This has in the past been a useful indicator of the long-term fair value of the currency.

As can be seen on the chart, the fair value of the rand is currently around R15/US dollar, with the current deviation (i.e., cheapness) of the rand in line with the extremes of the Covid-19 and Nenegate sell-offs. If the South African Reserve Bank (SARB) can continue to act independently in its mandate to anchor inflation within the 3-6% target range, there is a fair chance for the rand to return to fair value in time.

However, the currency can deviate from this fair value for sustained periods, primarily driven by three factors:

To move the rand back to fair value, we’ll need to see an improvement in a combination of these three factors, while the SARB remains in control of its inflation mandate. While the valuation of the rand is undoubtedly cheap and the SARB has maintained its credibility, we’re concerned that the global economic environment may not be supportive of the currency over the next year should the tight financial conditions result in a global recession.

Furthermore, the domestic (‘self-help’) factors depend heavily on an improvement in our electricity supply, and while investment in private generation should start alleviating some of the pressure in the future, the near-term outlook in terms of loadshedding remains worrisome. The national elections next year are further increasing investor uncertainty – the prospect of a coalition government that can take on a number of permutations with widely differing economic policy makes it difficult to take any bold views on the currency with confidence.

Another factor to consider is the higher offshore allowance for South African retirement funds (currently 45% versus 30% before 2022). Many pension fund managers were forced to repatriate funds during past spells of rand weakness so as not to breach the 30% offshore limit. This provided a natural countercyclical force for the currency. However, it seems as if most pension fund managers are currently still well below the revised 45% offshore limit, creating less impetus to start reversing the flow of money as was the case in previous cycles.

The recent market movements have resulted in attractive relative valuations for South African equities, bonds and the currency. In other words, there is already a great deal of pessimism priced into these assets. It would therefore be inappropriate to let fear drive indiscriminate selling of South African assets to buy foreign assets at these levels. Investors who did so in the 2001 cycle destroyed much material wealth over the following decade. We do, however, remain mindful of the structural challenges our economy faces. We’ll therefore continue to advocate for globally well-diversified portfolios, but guard against pro-cyclical portfolio changes driven by fear or greed.

When formulating your investment strategy, we focus on your specific needs, life stage and risk appetite.

Greg Stothart has spent 16 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.