From March 2003 until December 2017, the JSE South Africa Listed Property Total Return Index (SAPY) returned on average 22.6% annually, outperforming both the All Bond Index (10.1%) and the All Share Total Return Index (14.5%). Since January 2018, however, the SAPY has depreciated by almost 20.5%. For the reasons behind this dramatic decline, see our earlier article.

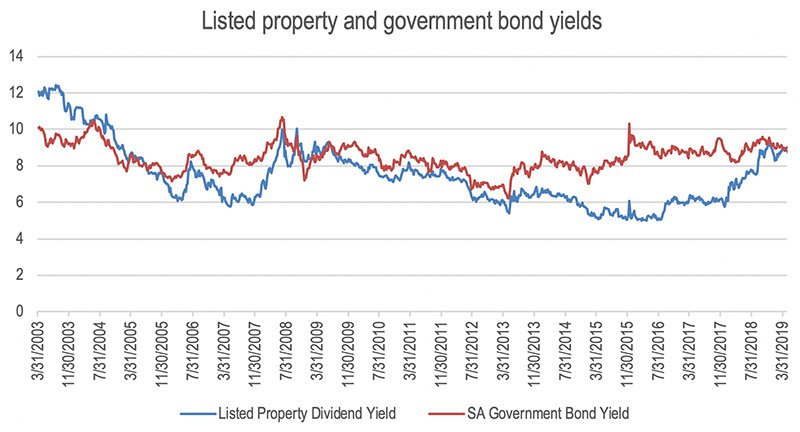

As can be seen on the graph below, in March 2003, listed property was trading at a yield of over 12%. It was an asset class unloved by the market (read: cheap), and this was the starting point for the performance that followed.

Source: iNet/SPW research

At the moment, the listed property dividend yield is similar to that of the SA government bond yield – the graph shows this ‘confluence’ also occurred in 2003 and 2009. From a ‘top-down’ or macroeconomic view, listed property is therefore now starting to show value relative to bonds. Note, however, that there are important differences between bonds and listed property. This macro view therefore shouldn’t be seen as more than a screening tool to identify relative value – it’s certainly not an indicator of absolute value.

A BOTTOM-UP VIEW

From a bottom-up perspective, there are specific reasons why listed property stocks are trading at these yields – reasons we take into account when we determine the valuation of individual companies. We focus in particular on a company’s ability to grow distributions. In order to do this, it can:

- Increase rentals of existing space with existing or newly leased tenants

- Lease up vacant space within the portfolio

- Acquire revenue-enhancing property where there is a positive spread between the cost of debt and acquisition yield

- Manage and reduce costs associated with the portfolio.

The current economic and operating environment in South Africa – characterised by sluggish economic growth, rising operating costs, struggling consumers, low employment figures and depressed business confidence – is far from ideal for listed property to perform well locally. If the above was a checklist, our local market scores poorly. Additionally, within the office and retail sectors, there is currently an oversupply relative to demand, which will continue to prevent landlords pushing through escalations.

NICHE SPECIALIST FUNDS

At Sanlam Private Wealth we prefer companies that manage their balance sheets pragmatically and don’t use gearing for the sake of it. Management teams need to be aware of the nature and quality of their assets and have a competitive advantage in the market if they’re to successfully drive distribution growth. Despite bad news being reflected in prices, we’ve come across a few stocks we find interesting:

- Vukile is a listed Real Estate Investment Trust (REIT) invested mainly in retail property assets in Southern Africa as well as in Spain and the UK. Locally, Vukile has differentiated itself through astute, value-adding capital allocation and active management initiatives. We’ve owned the share in our listed property portfolio but during Vukile’s successful accelerated bookbuild, we added it to our balanced portfolios. Trading on a forward yield of 8.8%, the counter looks attractive to us.

- Stor-age, also a REIT, is a specialist self-storage operator in South Africa and the UK. Its assets are located in prime locations within dense nodes, and management has sustainably grown rentals through improved operational performance and the expansion of existing assets. A large and diverse tenant base, coupled with a strong operating system and a needs-based product, will allow Stor-age to trade well through different economic cycles. We’ve held this stock for some time and it has rerated well. Trading on a forward yield of 7.7%, we’re happy to be investors.

In the final analysis, property is a cyclical business and price weakness often provides opportunities to invest at attractive yields. We’re starting to see value, but remain cautious about the overall sector given the deteriorating fundamentals, which aren’t likely to improve over the short term. Our preference remains for specialist niche funds with strong balance sheets and growth prospects that are able to extract value from their existing asset base through competitive advantage.