Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Second-level thinking:

asking the right questions

The investment world is teeming with smart and talented individuals – both professionals and laypersons – all striving to do well and outperform the market. To get ahead of the pack means not only doing things differently to everyone else, but also thinking differently. It means moving beyond what American investor and writer Howard Marks has coined ‘first-level thinking’ to a second level characterised by contrarian thinking, questioning conventional wisdom, digging deep and above all, asking the right questions.

Reading Moneyball: The Art of Winning an Unfair Game by Michael Lewis provides many insights into the human mind. The chapter that struck a chord with me relates to the labels baseball scouts use to describe players’ attributes. Epithets include ‘good face’ – referring to someone who looks like a star (what does this even mean?), ‘hose’ – meaning a person has a strong arm, ‘wheels’ – a fast runner, and ‘make-up’ – emotional stability.

From an investment perspective, these catch-all phrases sound eerily familiar. Investment professionals and investors alike use many labels to help them make sense of the markets. For example, ‘cheap’ means a company trades on a low price-earnings (PE) ratio, while ‘expensive’ refers to a high PE ratio. ‘Good management’ means many things but inevitably relates – incorrectly in our view – to medium-term share price performance. ‘Stable’ refers to a low-growth company that is a must-have for a portfolio. ‘Platform company’ is a relatively new term that generally describes technology businesses with seemingly limitless potential.

Psychologists Daniel Kahneman and Amos Tversky have written extensively about how these neat labels we create for the sake of efficiency often lead to poor outcomes. They make investments easily palatable to clients (and unfortunately sometimes also to investment professionals) but in truth, the market is not as simple as they suggest.

Let’s take the example of Daisy, a dairy cow, whose value we can reasonably assume is based on the milk she produces – in this case, R10 per litre. Assuming the price of milk doesn’t change and we ignore costs, the value of the cow is simply a function of expected production over a five-year period (I don’t know for how long cows actually produce milk). So what should a person pay for Daisy?

The point is that even in the case of a single dairy cow and very limited assumptions, the value of an asset will swing wildly based on your view or guess of what the future holds. Since there are so many more views and variables to account for when analysing a company, the stock market – and the prices paid – becomes a meeting place for expectations, especially in the short to medium term. It’s only after year five that we’ll truly know who made the better bid for Daisy.

It’s clear that figuring out what we need to pay for an asset is an exceptionally difficult task. We need to spend more (or less) time thinking about certain variables in order to assess whether a market price for an asset is fair or not. If we engage in first-level thinking, we’ll struggle to outperform the market. First-level thinking tends to assume a ‘good’ company is a good investment. Despite the logic to this argument, it’s often not the case. If the butcher, the baker and the candlestick maker all know that company X is a good business, shouldn’t we expect that this will be reflected in the share price?

The father of value investing, Ben Graham, illustrates two pitfalls in buying only ‘good’ companies: ‘The first is that common stocks with good records and good prospects sell at correspondingly high prices. The investor may be right in his judgement of their prospects and still not fare particularly well, merely because he has paid in full (and perhaps overpaid) for the expected prosperity. The second is that his judgement as to the future may prove wrong.’

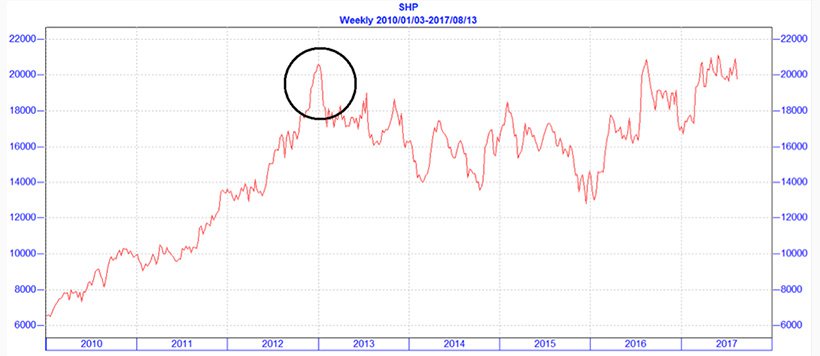

Graham’s words were penned in 1949, and yet we still fail to heed the lesson. Shoprite – over the last five years – is an excellent example of a good company failing to earn market-beating returns. In 2012, the company traded at a higher share price than it currently does:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Since the share price peaked in 2012, it has underperformed the market by 7.5% per year. Investment analysts and suppliers in the retail space would all agree that this is a very good company, but the price paid was not. I accept that I’m cherry-picking the extreme point here, but even if one bought at R100 in 2010, before the mania, you’d have received a return equal to the All Share Index today. The real investment opportunity in Shoprite started in 2003, long before Sandton residents envisaged buying wine and cheese from a Checkers store.

The correct, second-level questions to ask about Shoprite between 2010 and 2012 were: What are the market expectations regarding the company’s growth? Were these expectations realistic? What are our expectations relative to market consensus? What will happen to the stock price if we’re right? What are the chances that we’re right? Why would our estimates be incorrect? What’s the competitive environment like?

First-level thinking uses the investment labels referred to earlier, and digs no deeper. People need these ‘decision-making tools’ to make their lives easier, but investment jargon can be very misleading. These are the questions we need to ask:

First-level thinking looks for a method that will work in all scenarios – something simple and foolproof. The allure of this level of thinking is that it works for periods of time and can even lead to periods of outperformance. The Nifty Fifty stocks in the 70s and 80s, the tech boom in the 90s, and the mining boom in the 2000s were all good times for first-level thinkers – until things came crashing down and led to permanent capital losses. Second-level thinking will always guard against losing money.

At this point you may be wondering if anything works in investing. This piece is not intended to remove hope of outperformance, but to remind investors that there’s no simple way to outperform. The simple way may work for a period, but history has shown it always ends badly. Investing is not a science – or people much smarter than us would be successful at it. It requires an ability to continue to ask the right questions as well as an understanding of human nature. Over the long term, superior thinking will manifest itself in superior results. At Sanlam Private Wealth, we are under no illusions regarding the difficulty of the task ahead of us to maintain our track record – but we relish the opportunity to build on it.

To conclude with the words of American investor and businessman Charlie Munger: ‘It’s not supposed to be easy. Anyone who finds it easy, is stupid.’

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.