Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Sanlam Private Wealth global equity team’s

top 3 stock picks

Our global equity team has chosen three stocks expected to offer the most value to our investors. The shift in digital technologies to cloud-related software and services make Oracle and Cognizant two companies we favour, while Yum China’s significant growth opportunities in that country make it a top stock pick.

Oracle is an enterprise software company that develops, manufactures, markets, distributes and services database and middleware software, applications software and hardware systems. It consists mainly of computer server and storage products, and operates in three segments: software, hardware systems and services.

Oracle offers a full suite of its products through on-premise software licences, cloud, or both. The company is transitioning towards the cloud, but 51% of revenue still comes from licence updates (the company claims a high number of renewals) and product support. Most of its customers appear to be opting for a hybrid model with some software hosted on-premise and some delivered through the cloud.

Cloud offerings account for 25% of revenue and include software-as-a-service (SaaS) and platform-as-a-service (PaaS), which the company hosts, manages and supports. In addition, Oracle has a much more modest infrastructure-as-a-service (IaaS) business, which accounts for 2% of revenue, that the company is investing in and looking to grow over time.

The transition toward cloud-based solutions moves costs from capital to operational expenditure, while reducing the overall cost of ownership for customers. We believe PaaS represents a significant growth opportunity for Oracle as its offers its customers the ability to move applications running on Oracle databases to the cloud. While investors are concerned about the negative impact of this on revenue and earnings, we believe the market underappreciates the long-term opportunities for Oracle.

In 2016, Oracle acquired NetSuite for US$9.3 billion, which adds another level to its growth opportunity in the cloud. This business provides cloud-based business management products similar to those of Oracle, but NetSuite’s products are for the medium-sized business market while Oracle’s go into bigger enterprise businesses.

Our ongoing optimism in Oracle’s long-term business model is based on our view that over time the growth in cloud-related software sales will exceed the current declines in new on-premise software sales. If Oracle’s cloud-based businesses are growing more rapidly than forecasted, it will lead to accelerated revenue growth and operational leverage once the company works through the product delivery mix shift.

The stock is trading on a forward free cash flow yield of 7%, but growth has been anaemic because of subdued earnings growth – mainly due to a focus on cost efficiencies and aggressive stock repurchases helped by strong operational cash flow generation. The transition of Oracle’s business model may take several years but as long-term investors we believe the stock is attractive with the possibility of a re-rating once revenue growth returns.

Cognizant is a pure-play global IT services name with an attractive growth proposition driven by the shift in digital technologies. We see the business as well positioned to capitalise on market trends, given its focus on high-value and industry-specialised services.

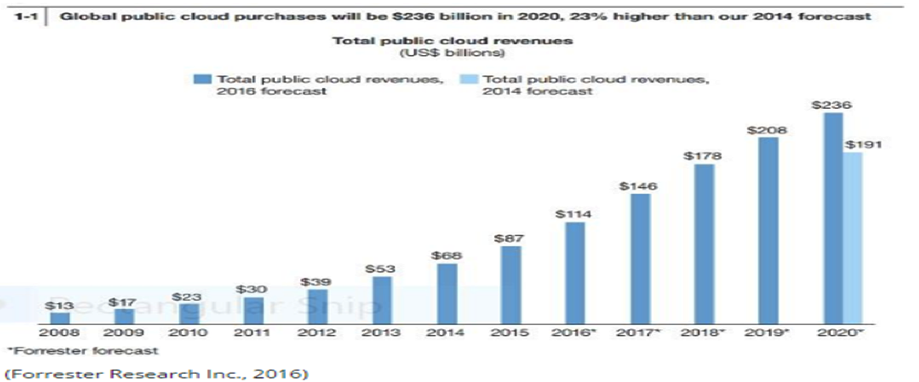

The company’s strong linkage to accelerating spending on cloud-based services should support its longer-term growth profile. When looking at projections for global spending in the cloud, both Gartner and IDC predict this will compound in the mid-teens until 2020:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

From a historical perspective, Cognizant’s focus on the cloud and ‘higher value’ services has resulted in the company achieving sector-leading market share gains. While we acknowledge that growth may moderate from here (historically around 20% per annum) as the company starts to achieve scale and greater penetration, investors shouldn’t lose sight of the fragmented nature of the industry and the secular long-term tailwinds. The company is transitioning as it has grown in scale and together with its solid strategic customer base, provides the support for an appealing growth profile.

The visa reform risks in the US are expected to continue to weigh on the stock as investors are concerned there’ll be significant reform, but we consider this an unlikely scenario. We believe any reform is likely to be watered down, and Cognizant can mitigate the cost by hiring more US employees, Ultimately this is a cost-plus industry in which cost inflation is passed through to customers.

Cognizant recently announced changes to its digital strategy and capital allocation policy. The company is planning to expand its operating margins to 22% by FY19 from the current level of 19.5%. There will be greater focus on the growth opportunities in digital transformation and services to meet client needs. The company is set to return US$3.4 billion over the next two years (buy-backs and dividends) and is targeting US$1.2 billion in share buy-backs each year in FY17 and FY18. On an ongoing basis after 2019 it is aiming to return 75% of US free cash flow to shareholders.

We believe the announced changes are moves in the right direction to ensure long-term growth of the business and shareholder returns.

Cognizant has excellent balance sheet strength, robust free cash flow generation and an attractive growth profile. The acquisitions made in healthcare have strengthened the company’s position, which we see as an exciting opportunity, enabling it to take advantage of the technological evolution within the US and global healthcare arena. In our opinion it’s well positioned to capture growth from structural developments within the financial services sector, as companies transition and develop their digital services.

Cognizant is trading at a discount to its own long-term historic trend on a forward multiple of 16 times FY17 earnings and below the intrinsic value we place on the business. While we acknowledge that this growth could well be moderating from the levels the markets had previously been accustomed to, we believe the market currently underappreciates the appealing long-term growth potential for the company.

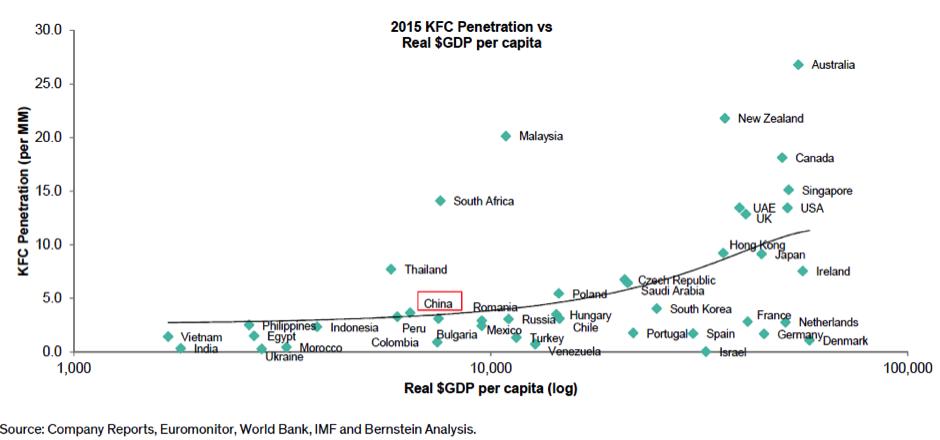

Yum China owns and operates more than 7 200 fast-food restaurants across China in four popular quick-service chains: Pizza Hut, KFC, Taco Bell and Little Sheep. It’s the largest independent restaurant company in China. Yum! Brands spun off its Chinese operations to create two separately traded public companies, each with its own strategic focus – Yum China Holdings now has around 4 250 KFC locations in China, most of them corporate-run.

The company aims to grow its footprint significantly to tap into a growing middle class and take advantage of increased urbanisation in China. The company has no debt and therefore cash generation can be used either to grow the company or reward investors with cash returns.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

The opportunity for Yum China can be split into three categories:

The company continues to invest in its digital and delivery capabilities as part of its strategy to capture the rapid growth in demand for those services. Along with the three core opportunities, we view these as supporting YUM China in achieving its long-term implied targets of compounding revenue at 10% and earnings at 15%. The stock is currently trading on a prospective free-flow yield of 5% and forward multiple of 20 times 2017 earnings, which we view as appealing for this growth stock.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

When formulating your investment strategy, we focus on your specific needs, life stage and risk appetite.

Greg Stothart has spent 16 years in Investment Management.

Have a question for Greg?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.