Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

SURVIVING THE

DIVIDEND DROUGHT

This year is likely to be challenging for income investors – the economic impact of COVID-19 has compelled many JSE-listed companies to suspend dividends to ensure they don’t run into financial difficulty. In our view, the best strategy for investors is to try and tighten the belt from an income point of view over the short term – and ride out the dividend drought. Once the pandemic is finally behind us and the world returns to some semblance of normality, most companies should resume dividend payouts.

Read more below or listen to Renier's views here:

‘Cash is king’ is a popular phrase describing the preference of businesses and investors for cash. Cash flow is the lifeblood of every business – it provides liquidity to investors and is straightforward in terms of value (R100 in cash is simply worth R100).

Dividends are the excess cash that businesses can distribute to their shareholders after meeting their ongoing business cash flow requirements. They are therefore a good indicator of a business’s power to generate free cash flow, provided it is retaining adequate funding to meet future business needs.

For dividend-focused investors, assessing the sustainability of a company’s dividend payments is crucial – a high dividend yield in itself may potentially signal the market’s concern over the ability of the business to grow its dividends in future. We’ve seen cases in our local market where listed companies ‘over-distributed’ dividends, which eventually contributed to a strained balance sheet when they went through a difficult period. Examples include African Bank (ABIL), Anheuser Busch and a number of listed property shares.

Interestingly, an investor who purchased ABIL at the start of 2005 for R13.66 would have received a total of R15.37 in dividends per share – more than the original investment – by 2013, before the bank collapsed in 2014. If ABIL had a more conservative approach to accounting for bad debts (as Capitec did), resulting in less generous dividends, the story might have played out differently.

Many investors prefer high-dividend-paying shares in order to receive an income without having to sell shares for this purpose. At Sanlam Private Wealth, we prefer to have a total return focus (valuing capital growth and income equally) when we construct share portfolios, for these reasons:

Companies that can reinvest capital into their businesses at a higher rate of return than the general market is likely to provide for investors, should do so, rather than distribute dividends. Those with more muted (or speculative) prospects with regard to available capital should rather return the cash to shareholders. This probably applies to most companies, as only a few have demonstrated that they can consistently reinvest their capital at high returns. Many more have failed through new ventures or acquisitions that have fallen short of expectations.

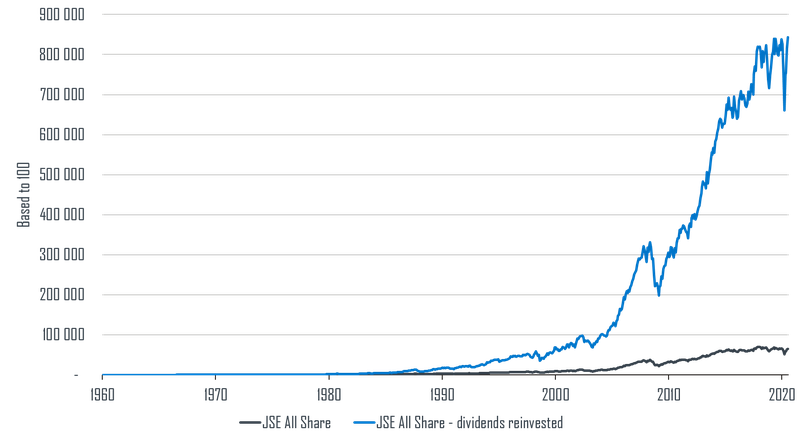

Over the long term, dividends (if reinvested) contribute meaningfully to an investor’s total return. The chart below shows the performance of the FTSE/JSE All Share Index with and without dividends since 1960:

The impact of dividends reinvested

Source: Iress, SPW Research

This year is likely to be particularly difficult for dividend income investors, as the economic impact of the pandemic has forced many companies to put dividend payments on hold in order to preserve their balance sheets. Even stalwart South African dividend payers such as banks and insurance companies will have to skip dividend payments under advice of the Regulator.

While this may be disappointing for investors who hold these shares for their dividends, we view this as a prudent move to strengthen balance sheets until the world returns to normal. A bankrupt company can’t return to paying dividends in the future, while cash that is retained for now will stay on the balance sheet and can always be distributed later.

To add to the woes of income investors – while borrowers are celebrating the 300 basis point cut in the prime rate so far this year, it will come at the expense of the interest rates that savers will earn on their bank and money market deposits. The prices of many of the dividend shares have also come under pressure, which could have a negative long-term impact on an investor’s capital base should they sell some of these shares at these levels to supplement income.

In our view, the most appropriate strategy at this stage would be for investors to try and economise as much as is feasible from an income point of view over the next few months, and ride out the dividend drought until companies reinstate dividends once the COVID-19 pandemic is a thing of the past. The lower interest rates on savings also increase the relative attractiveness of South African dividend-paying shares, especially at their current depressed prices.

In our Dividend Income portfolio, we invest in companies with above-average dividend yields, but also with the ability to sustainably grow these dividends ahead of inflation over time. While the next year’s yield may be impacted by a few companies deferring dividends, the expected dividend income yield on the portfolio is around 7% for the year thereafter. This remains an attractive return relative to money market rates, even before the prospective capital growth and the more favourable tax treatment for high marginal tax rate investors are taken into account.

When formulating your investment strategy, we focus on your specific needs, life stage and risk appetite.

Greg Stothart has spent 16 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.