Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

The value of hedge funds

in a multi-asset portfolio

Alternative investment instruments such as hedge funds have often been avoided by traditional investors who may not be aware of the opportunities they present to better protect invested capital as part of a robust portfolio. At Sanlam Private Wealth we offer hedge funds in our multi-asset solution, to ensure our clients’ portfolios are well diversified and positioned to generate returns in both normal and extreme market conditions.

The importance of a well-diversified investment portfolio to protect against market risk cannot be overemphasised. But even though a diversified equity portfolio can eliminate company and sector-specific risks, it may still be heavily exposed to the market’s general direction. The inclusion of bonds, with returns largely uncorrelated to equities, has become a common way to protect the capital of investors who may not want full exposure to equity risks. Apart from a small allocation to cash, this is the extent to which the traditional investor tends to diversify their portfolio.

A world of investment opportunity remains untouched by these investors. Hedge funds (essentially pooled funds that use derivatives and apply various strategies to generate uncorrelated returns to equities), private equity and agricultural commodities are but a handful of the investable instruments presented as alternatives, due to their returns being largely independent of traditional financial markets.

Why then have traditional investors been reluctant to invest in these instruments? Primarily because alternative investments often require large initial investments, or because the nature of the markets in which they trade are either illiquid or unregulated. As a result, many have come to see alternative investments as a luxury enjoyed by only an elite few.

South Africa’s first hedge fund was launched in 1998 with many more following, but recent years have seen major changes in the industry. With hedge funds now regulated under the Collective Investment Schemes Control Act (CISCA), a wider set of investors can enjoy access to these alternatives in a well-regulated, liquid environment. The returns of a carefully selected set of hedge funds can be largely uncorrelated to traditional asset classes under stress. This means an investment in a fund of hedge funds diversifies exposure across a number of expertly selected hedge funds, and is able to be both a diversifying and return-generating component in an investor’s portfolio.

When selecting a diversifying asset as part of a more sophisticated approach, one should naturally consider its ability to add value in both normal and extreme market conditions. In doing so, it is of utmost importance to consider the cost – noting that this doesn’t only mean the sum of fees paid, but also the return sacrificed under normal conditions to cater for the extreme. In other words, cost is the difference between the diversifying asset’s after-fee return and the return of the asset against which protection is typically sought.

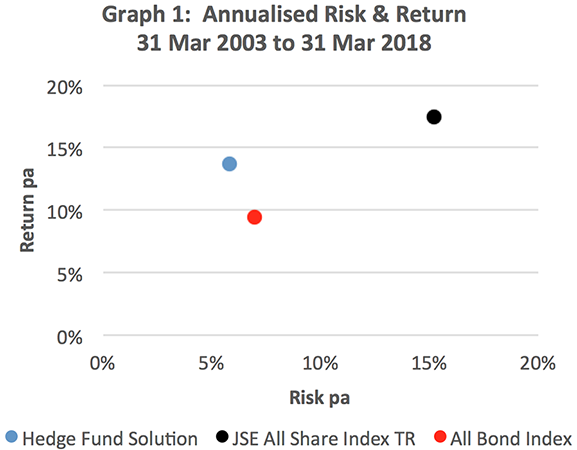

Graph 1 considers the longer term, annualised risk and return characteristics of equity, bonds and a hedge fund solution* over the past 15 years. The farther left the asset finds itself on the graph, the lower its volatility, and the higher up it is, the better its return.

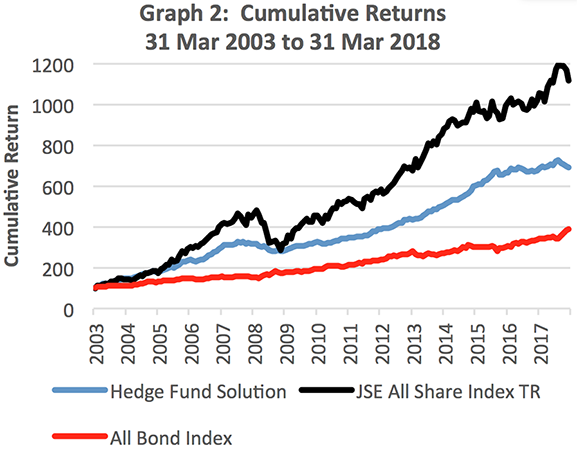

The significantly lower volatility of the hedge fund solution and bonds in comparison to equity indicates that their inclusion in a portfolio reduces risk. Also, at a lower volatility than bonds, the hedge fund solution generated an annualised return of 13.73% (after all fees), while bonds returned 9.48%. This effectively means that in terms of returns sacrificed, the hedge fund solution was a considerably less costly diversifying asset. The cumulative effect over the 15 years is shown in Graph 2.

* The performance used for the hedge fund solution in this analysis is after all fees and represents the actual fund of hedge fund track record of the portfolio manager at THINK.CAPITAL.

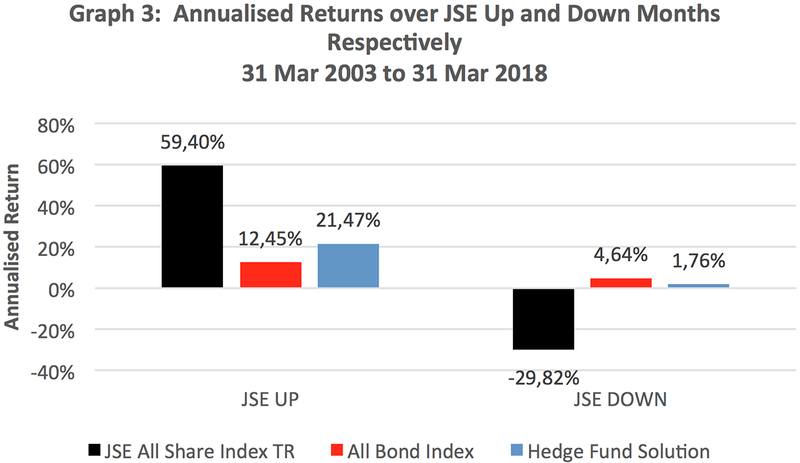

To consider the diversification during extreme periods, bonds and the hedge fund solution returns are viewed over all equity up-market months separately from all the months in which the JSE incurred a loss. Graph 3 shows that the hedge fund solution’s outperformance of bonds was due to more effective participation in upmarket months (returning 21.47% per year), while exhibiting fairly similar positive returns when equities were down (1.76% per year).

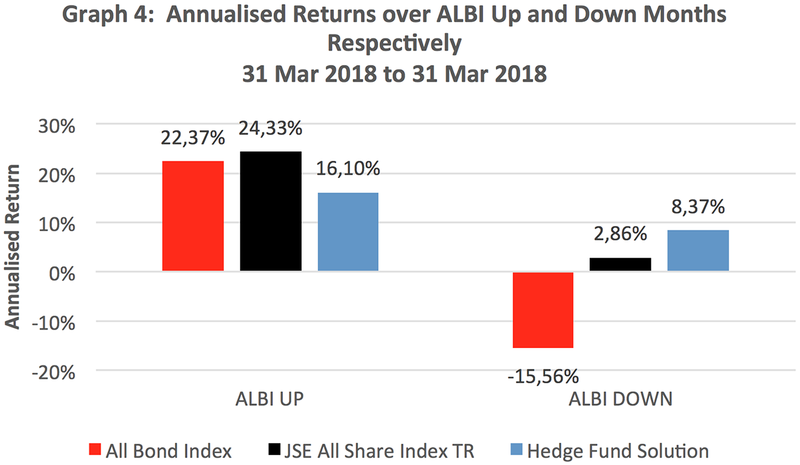

The hedge fund solution should not simply be seen as a substitute for bonds, however. In a similar analysis, this time separating bond up-months and down-months, Graph 4 shows the hedge fund solution’s returns as largely uncorrelated to bond returns over extreme periods. An annualised return of 8.37% was generated by hedge funds over all All Bond Index (ALBI) down-months.

The complementary nature of hedge funds to both equity and bonds creates an opportunity to construct a robust portfolio to better protect invested capital, with the potential of generating returns in line with equity over time. At Sanlam Private Wealth we’ve included hedge funds in our multi-asset solution, providing our clients with access to additional sources of return to meet each client’s specific needs.

Elmien Wagenaar, Investment Manager and Director of THINK.CAPITAL, contributed to this article.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.