Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Sip on the world’s

most patient drink

It’s shrugging off its stuffy reputation and is now less country club than streetwise (albeit well-heeled). But inhale deeply and you’ll get a whiff of its unrivalled pedigree. Cognac, anyone?

Settling into their seats, the audience waits to see a newly released film by a long-dead and near-forgotten actor, John Malkovich. Just as he had intended, a century ago.

Today, of course, Malkovich is still breathing but unless he learns a secret that so far eludes medical science, he won’t be around when his film 100 Years has its first-ever screening. The movie is the result of collaboration with French cognac maker Remy Martin. The distillery, in turn, produces a distinct 100-year-old cognac, Louis XIII.

Until the year 2115, Malkovich’s project will sit quietly in a vault until its appointed date with a yet-to-be born audience. Just as any new batch of Louis XIII set aside now will never be tasted by the men who crafted it.

Remy Martin’s concept of reminding its connoisseurs of their mortality is visionary, and very French. As is cognac itself, which is really just another name for brandy. France has, however, defended the brand, named for the village in the region from which it originates. Elsewhere in the world, it is better known as what the Dutch called ‘burned water’.

Cognac, or brandy, is one of the very few spirits to be distilled from another liquor – in this case wine. It is as Samuel Johnson put it, the grown-up version of the fruit of the vine. ‘Claret is the liquor for boys,’ Johnson said, ‘port for men; but he who aspires to be a hero must drink brandy.’

Cognac as a brand may be exclusively French, but its South African cousin, brandy, is no poor relation. A 40-year-old potstill brandy from Stellenbosch’s Van Ryn’s Distillery sold for R60 000 recently at the Nederburg Charity Auction. In fact, says Christelle Reade-Jahn, director of the SA Brandy Foundation, we make some of the best in the world.

Cognac, in southwestern France, is the spiritual home of this rarified drink

South African production standards for potstill brandies are the most stringent in the world, according to Reade-Jahn. ‘We did an overview of 12 brandy-producing countries and their production methods, and we are the most stringent in terms of quality of base wine, distillation in copper potstills, and maturing the brandy for a minimum of three years in French Oak casks of no more than 340 litres (required by ‘law’),’ says Reade-Jahn.

Brandy goes through a hands-on process of small-batch distillation

South Africa’s products are indeed world class. Says Reade-Jahn: ‘Our brandy masters are experts in blending this matured spirit into smooth and fruity brandies. The result of these high production requirements is that we have won the title of Best Brandy in the World more than any other country — 19 times since 1981.’

It is sometimes easy to miss that South Africa is not a true ‘new world’ wine producer – having planted vineyards for centuries before the Americans, Australians and Chileans got in on the act.

South African brandies are, like French cognac, right up there with the best — just as our sparkling wines rival genuine champagne in quality. It is not simply talk – local brandies have won awards where it counts.

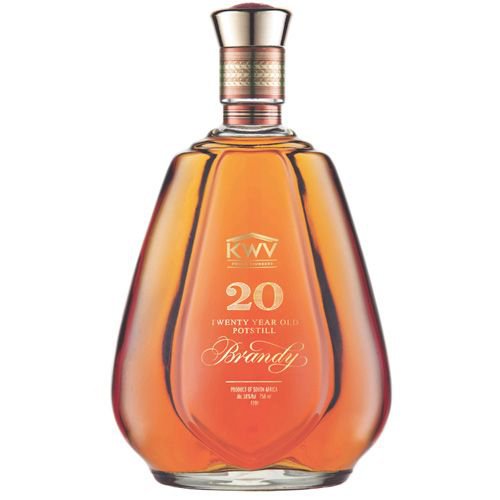

This year, for instance, KWV won the title for best brandy at the International Wine and Spirit Competition against thousands of entries. KWV’s 15-year-old Potstill Brandy achieved an Outstanding Gold (a score of 93/100 or more) and the Worldwide Trophy for Brandy – outscoring all other brandies – at the competition.

This was followed up by KWV’s win of World’s Best Brandy/Cognac Producer for the second year and World’s Best Brandy for its KWV15, at the International Spirit Challenge in London in July. In doing so, KWV trumped cognacs and brandies from 70 countries – including France.

KWV won the title for best brandy at this year’s International Wine and Spirit Competition against thousands of entries

KWV Master Distiller Pieter de Bod says this is all down to following a process that relies on patience — a lot of it.

‘We allow for decades of maturation – in the instance of the KWV 20-year-old, it can include brandies of up to 32 years in age – to allow for the quality and purity that give our double-distilled potstills their internationally competitive edge.’

Local varieties also benefit from our long tradition of cultivating vineyards in the Cape sunshine. These are transformed into the fine wines we all know. Although, some argue that the best brandies and cognacs are distilled from the harsher, more acidic wines.

This is a crucial final point in getting to grips with both cognac and brandy. It is one of the few alcohols that are produced not from virgin fruit, but from an already fermented product – in this case wine.

‘Brandy is unique in the fact that it is made from another alcohol, essentially wine,’ says the Brandy Foundation’s Reade-Jahn.

The process requires patience – lots of it

‘It goes through a hands-on process of small-batch distillation and is a completely authentic spirit. Brandy has a vast array of aromas naturally occurring in the spirit — these vary from floral and fruity, through to spicy or chocolate.’

Meanwhile, in the distant future, moviegoers will be settling down to enjoy a century-old film production brought to them by liquor crafted by long-dead distillers. If they can manage to dig up an old-time projector, that is.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.