Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Our Investment

Philosophy and Process

Our investment philosophy rests on three pillars: price, perspective and pattern.

We believe that…

The price of an asset or asset class is the dominant factor driving investment performance over the longer term.

Perspective can only be gained through thorough proprietary analysis and research, essential to building the correct investment thesis underlying an asset or asset class. We also believe the correct view of the macro environment is important in understanding the price movements of assets or asset classes.

Financial markets aren’t always logical, and they don’t work in a sequential way. While historical patterns aren’t necessarily repeated in a particular order, we believe they can provide excellent clues as to what can be expected from an asset or its price in future.

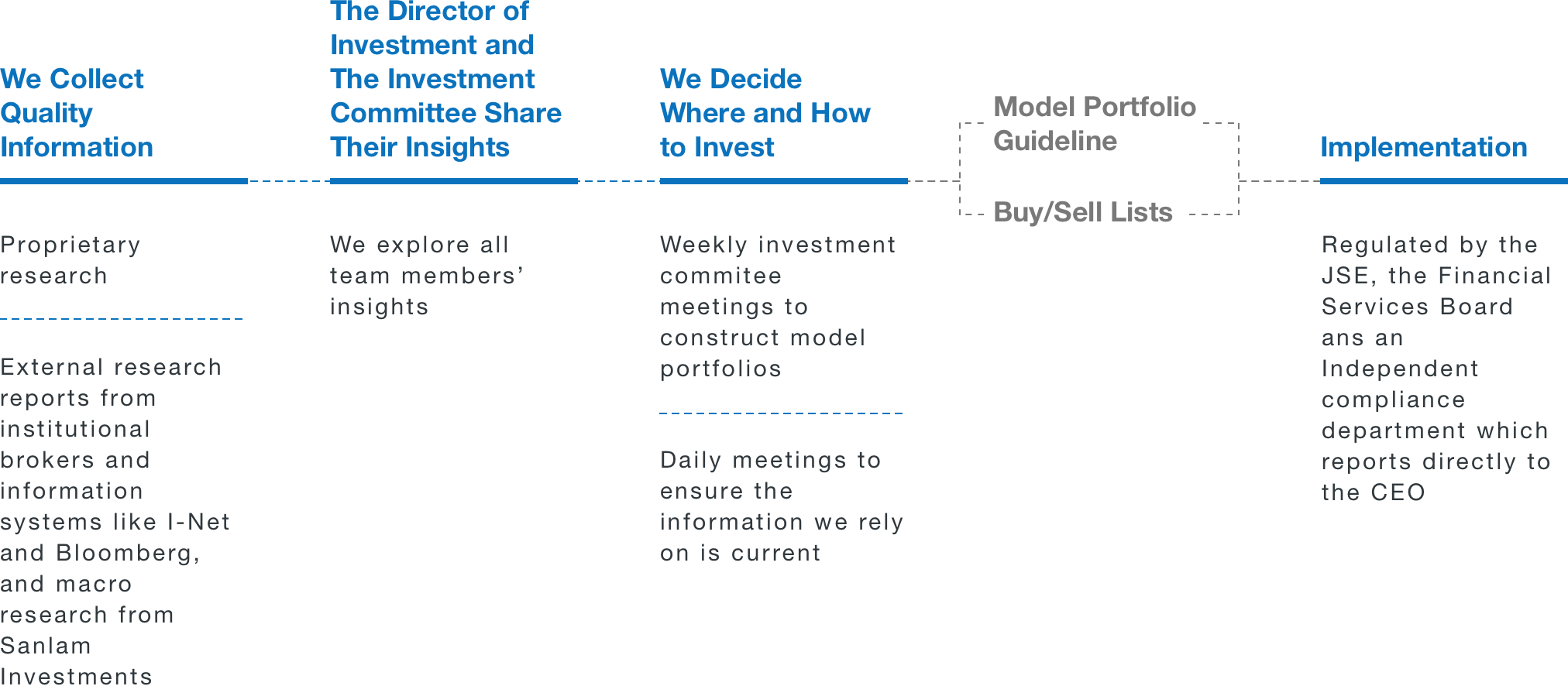

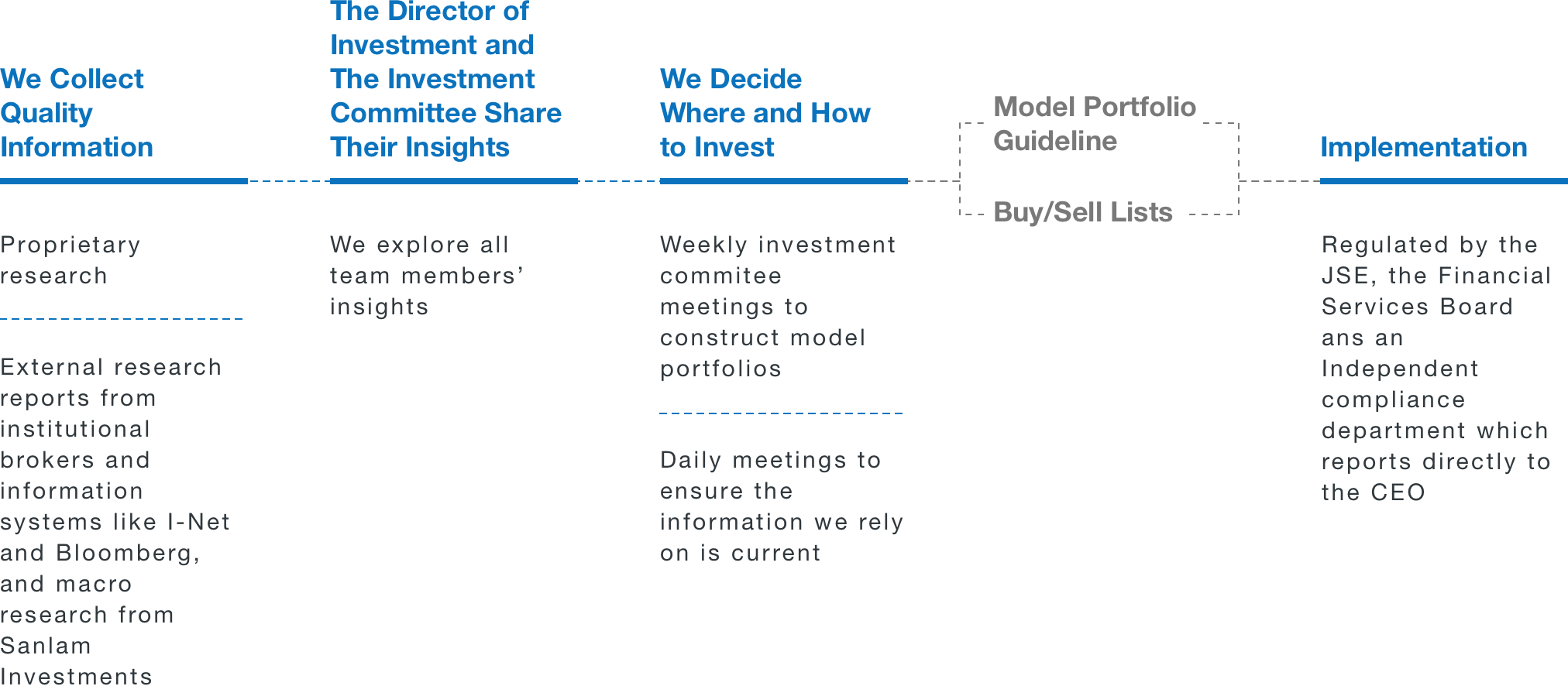

We have a systematic, centralised investment process grounded in robust research. We constantly challenge the norm and ask the tough questions.

Apart from relying on their years of experience in the investment world, our investment committees (South African and global) tap into numerous sources of information and analyses, as we assemble informed, intelligent investment decisions to meet your individual needs.

Our investment methodology marries a top-down and bottom-up approach in the construction of our portfolios. For us, top down means reviewing and assessing a portfolio’s asset allocation. The bottom-up approach looks at stock selection.

Our investment philosophy of price, perspective and pattern is crucial when we decide on the appropriate asset class composition:

Through this process we quantify our expected returns and the volatility for each asset class over the medium to longer term and we apply this insight to your objectives and risk profile.

When selecting equities we seek companies capable of delivering earnings and dividend growth at attractive valuations. Crucially, we want to make investments in companies in which we believe through an investment cycle and not speculate on short-term price movements.

We prefer to invest in companies that have:

We provide daily reporting of trades, monthly portfolio evaluations and annual tax reports to clients.

Riaan Gerber has spent 16 years in Investment Management.

Have a question for Riaan?