Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Budget 2018:

SA now needs to walk the talk

After the dramatic political events of the past few weeks, last week’s Budget Speech delivered by then Finance Minister Malusi Gigaba was a particularly important one – in light of our country’s current unsustainable fiscal path as well as the risk of a credit rating downgrade by Moody’s still looming large. In our view, the 2018/2019 Budget does make a clear attempt to address these concerns. It now remains to be seen how President Cyril Ramaphosa’s government will walk the talk and implement the tough measures needed to plug the holes inherited from the previous leadership.

During the eras of former finance ministers Trevor Manuel and Pravin Gordhan, the main Budget Speech became a non-event from a financial market perspective. Both ministers used the Medium Term Budget Policy Statement (MTBPS) to signal broadly what the public and financial markets could expect later in February. In recent years, however, there were increasing signs that our finance ministers were using a rather confusing roadmap. It was clear that the South African fiscal path was an unsustainable one, with debt building to levels with an ultimately disastrous outcome for the economy.

Minister Gigaba painted this picture in brutally honest fashion late last year – economists and the general public therefore had every reason to follow the 2018/2019 Budget with interest. Of course, with the recent regime change within the ruling party, it was also important to look for consistency between the State of the Nation Address (SONA) and the National Budget. Despite speculation that we might not see Minister Gigaba delivering the Budget in Parliament last week, it was indeed he who took to the podium.

Besides the pressing economic issues that needed to be addressed, this was also a crucial Budget in the context of the risk of a downgrade by rating agency Moody’s still firmly on the table. South Africa is currently only one notch above sub-investment grade status on both its foreign and domestic currency ratings. Moody’s would have been looking for clear plans to close the primary budget deficit, either through increases in revenue or through decreases in expenditure. In our mind, the Budget does make a clear attempt to address these concerns.

Against the background of slightly higher growth expectations for the year, revenue is expected to increase by 10.6% to R1 491 billion. The tough part, though, was an increase in taxes that will have an impact on the disposable income of a wider base of income earners. This is in contrast to the 2017/18 Budget, where higher income earners largely had to fund the increased fiscal spending. Indeed a brave political decision.

Additional income of R36 billion will be primarily sourced from an increase in the VAT rate from 14% to 15%. This increase is likely to contribute R22 billion. Other measures put in place to raise additional revenue include:

Expenditures are expected to increase by 7.3% to R1 671 billion. This number looks modest, as it represents a real increase of only 2.1%. In fact, the Minister indicated that reductions in spending of R85 billion have been approved over the medium term. Items increasing by more than inflation include basic education (6.1%), tertiary education (21%), healthcare (9%) and social protection (7%).

Over the medium term, government is expected to provide R57 billion for free higher education. Of course, the viability of this is debatable – but it’s clear that the new regime had to own up to the promises made by former President Jacob Zuma when he was fighting for survival late during his tenure.

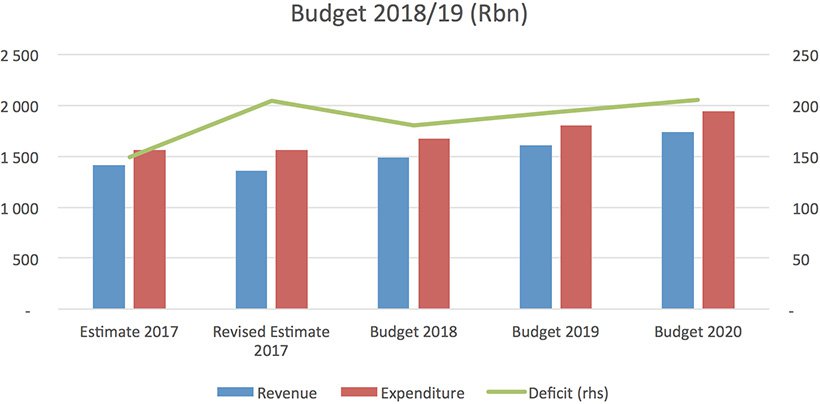

This leaves a primary deficit of R180 billion for 2018/19, which is to be financed predominantly by domestic loans. The chart below summarises the Budget outlook going forward. Importantly, although the deficit increases in nominal terms, it’s expected to peak at 3.59% of gross domestic product (GDP) in 2019/20 and decrease to 3.53% of GDP in 2020/21. This is an improvement on previous expectations.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

In addition, the debt-to-GDP ratio no longer reflects the ‘jaws of the crocodile’ referred to in our commentary on the MTBPS. Rather, debt to GDP is increasing more modestly to 55.1% in 2018/19, and is expected to stabilise at 56.2% in 2022/23. Behind this statistic is the assumption that GDP will increase at faster rates than assumed in the MTBPS. More specifically, GDP growth is expected to be 1.5% for 2018 (MTBPS: 1.1%), 1.8% for 2019 (MTBPS: 1.5%) and 2.1% for 2020 (MTBPS: 1.9%).

Is this overly optimistic? Our view is that this assessment is fair, given the change in investor sentiment since the election of Cyril Ramaphosa as our president. Increased confidence from consumers and business should lead to improved consumer spending and investments from the private sector. The recent strength of the rand will improve the outlook for inflation and hence also interest rate expectations.

Other highlights in the Budget Speech included a discussion on the health of state-owned enterprises (SOEs) and the support to be offered to them in future. President Ramaphosa stated in his SONA that government is committed to reforming the SOEs by improving governance and encouraging private sector participation.

It was confirmed that some support for SOEs may be needed, and that this will be financed through a combination of the disposal of non-core assets, strategic equity partners and direct capital injections. Government owns around 195 000 properties worth in the region of R40 billion, which will be disposed of in the medium term to further support SOEs.

From an investment perspective, euphoria is likely to further support companies with significant South African exposure. However, even though the sentiment has swung, it remains interesting how the market has punished expensive SA Inc shares when they failed to deliver according to expectations. On the other side of the coin, the stronger currency is likely to weigh against rand hedge shares in the short term.

With regard to the tax changes, the increase in personal taxes (through constant tax brackets) and luxury goods tax is likely to have a negative effect on durable goods purchases. In addition, the increase in VAT will likely have a slight negative effect on consumer spending in general. The increases in fuel tax will also negatively impact consumer spending power, as well as increase input costs in the primary and secondary sectors of the economy.

With regard to the tax changes, the increase in personal taxes (through constant tax brackets) and luxury goods tax is likely to have a negative effect on durable goods purchases. In addition, the increase in VAT will likely have a slight negative effect on consumer spending in general. The increases in fuel tax will also negatively impact consumer spending power, as well as increase input costs in the primary and secondary sectors of the economy.

The increase in the estate duty rate could necessitate a closer look at liquidity requirements in estates on death, and in many cases could change the debate as to whether a South African trust should be retained or not. The recommendations by the Davis Tax Committee regarding the abolishment of the interspousal relief for estate duty and donations tax purposes didn’t crystallise, which is in all probability the reason why the rebate for estate duty was not increased to the recommended R15 million per individual estate, but was kept at R3.5 million.

We recommend that donations are closely monitored on an annual basis, in light of the increase in the donations tax rate to 25% for donations above R30 million in any tax year, effective from 1 March 2018.

It was proposed in the Budget Speech that the official rate of interest in the Income Tax Act be adjusted. The official rate of interest is the current repurchase rate plus 100 basis points (at present 7.75%). This rate is used in terms of section 7C of the Income Tax Act to calculate the donation amount on low interest or interest-free loans to trusts and companies for donations tax purposes on an annual basis. The proposal is for this rate to be increased to a level closer to the prime rate of interest. If this proposal is brought into effect, we recommend that annual donations on these types of loans be carefully calculated before paying the donations tax, to avoid underpayment issues.

Widening of the scope of the controlled foreign corporation (CFC) rules to foreign companies held by foreign trusts is also on the cards again, but this will require some very delicate drafting to ensure that unintended consequences do not arise.

Of interest is the proposal to address the treatment of cryptocurrency transactions more efficiently by amendment to income tax and VAT legislation, which is an amendment to look out for during the year. The capital gains tax inclusion rates were not increased. No proposals were made to change the taxation of trusts and the conduit principle applicable to trusts.

In conclusion, government certainly talked the right talk in the 2018/2019 Budget, which is likely to be enough to avoid a downgrade by Moody’s. However, it remains to be seen how government will implement the measures announced, especially delivering on the proposed cuts on expenditure.

(This article was written in collaboration with Marteen Michau, Head of Fiduciary and Tax, and Christiaan Bothma of the SPW investment team).

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.