Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Impala Platinum:

still set to outperform

The share price of Impala Platinum, the second-largest platinum producer in the world, reflects a company and industry struggling to keep head above water. We invested in the company last year, as we disagreed with the market’s assessment on its valuation and anticipated that the share would outperform over the longer term from a low base. A year later, the share has lost further ground against the market. We still believe our investment thesis makes sense – but patience is required to see it unfold.

In July last year, we made the case for Impala Platinum, and we’re still positive about the share. Here’s why:

The hype around electric vehicles as a replacement for internal combustion engine vehicles is gaining traction. Although we agree with the market that the number of electric vehicles is set to grow exponentially (it’s currently less than 1% of the total vehicle market), we believe the effect of this on platinum group metals (PGMs) is overplayed. In our view, gasoline vehicles will continue to play an important role. Also, we expect that hybrid vehicles (a mix between electric and internal combustion engines), which still require a catalytic converter, will also play a vital role in the foreseeable future.

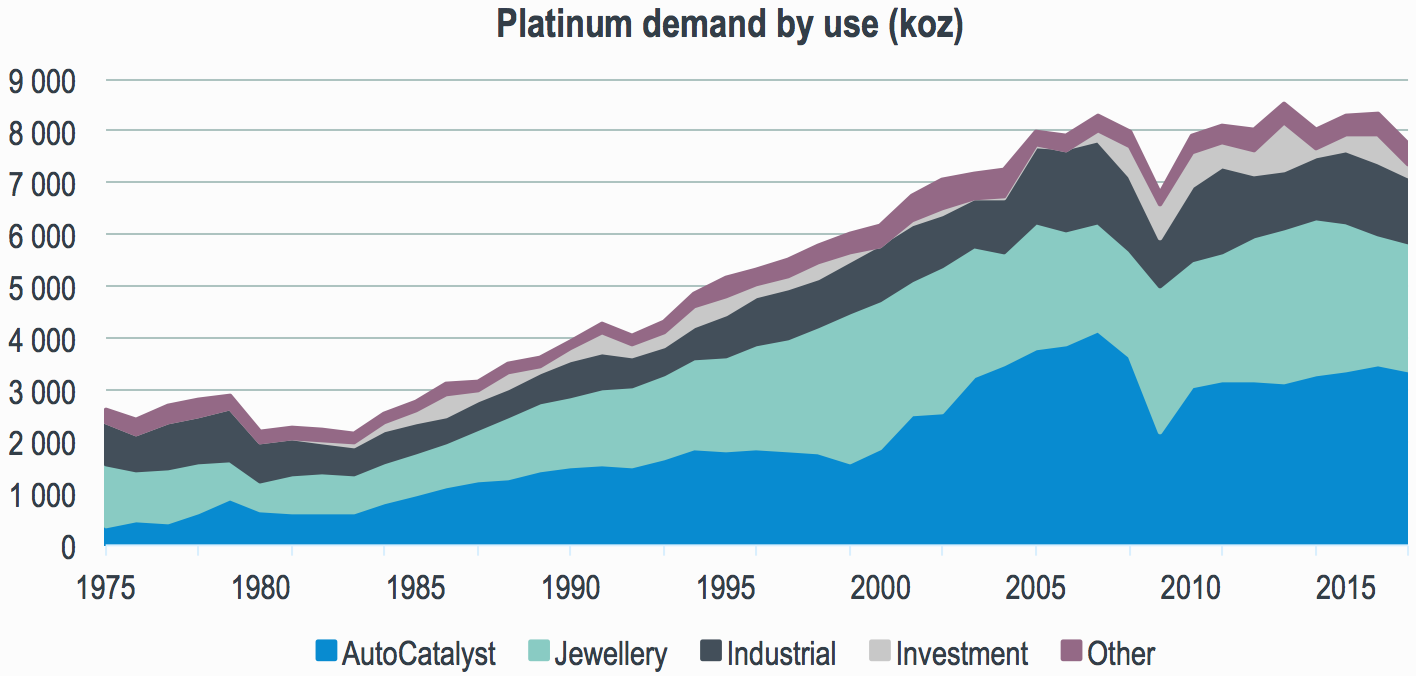

To provide some context, platinum has three main uses: jewellery (30%), as a catalyst in various industrial applications (20%) and as a catalyst in gasoline vehicles (40%). The role of platinum in gasoline vehicles (predominantly diesel) is to facilitate the chemical process of oxidising dangerous carbon monoxide into carbon dioxide and water vapour. Increased emission standards in the preceding decades have led to increased demand for platinum as an autocatalyst. However, the global financial crisis, more efficient use of the metal and the recent dislike and distrust of diesel in Europe has led to demand coming under pressure over the past decade, as the blue bar in the graph shows:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

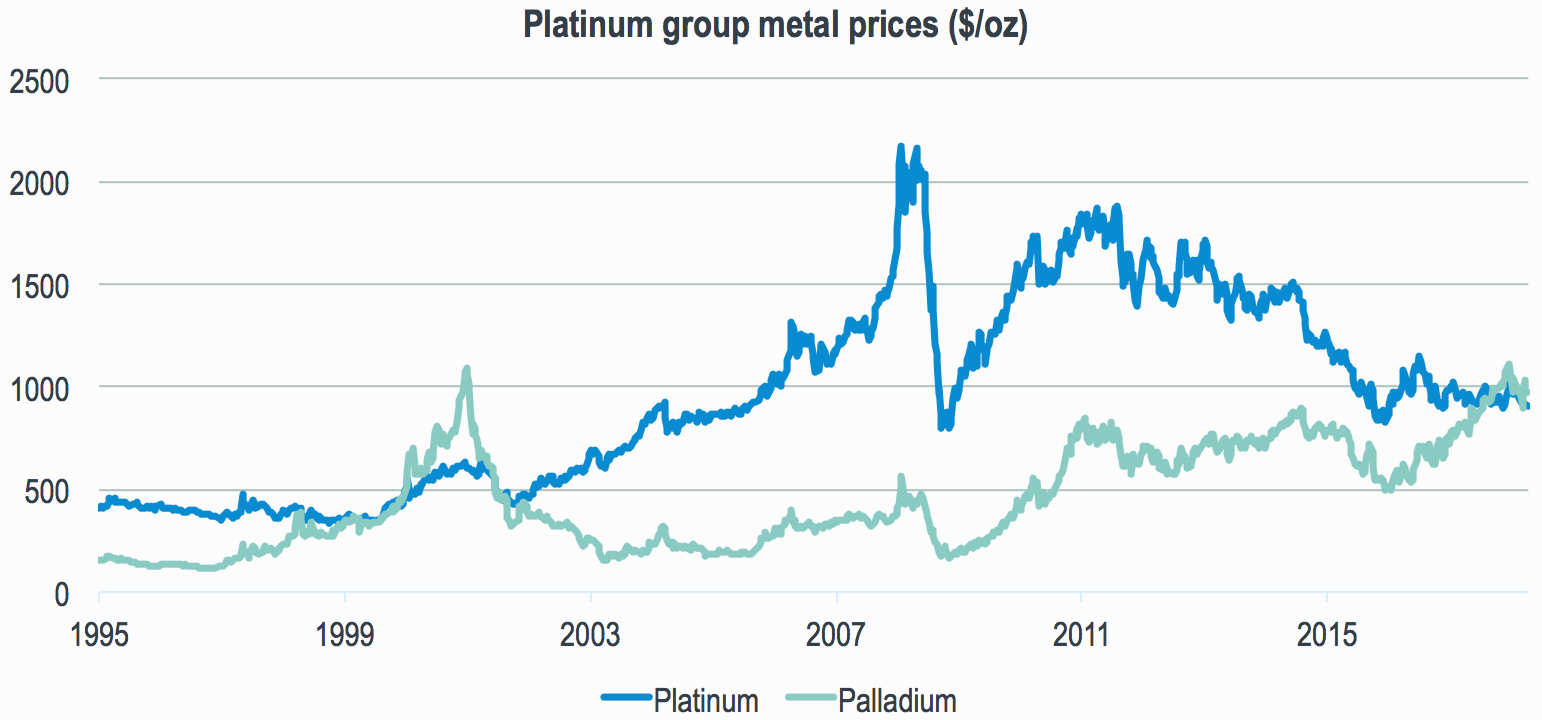

The decline in the demand for diesel, specifically in Western Europe, has resulted in an increase in the sales of petrol vehicles, which in that region predominantly use palladium (in petrol vehicles, platinum and palladium are equally effective). Consequently, the palladium price has increased to historic highs, rising above the platinum price for only the second time in history.

Although an increasing palladium price is positive for South African PGM producers, for most, the bulk of their PGM production is platinum. For example, Impala produces around 50% platinum, 30% palladium and 20% other PGMs, making the platinum price its most important variable. In the medium term, palladium autocatalysts may be switched to platinum in gasoline vehicles, which would imply that the palladium and platinum price should trade in close proximity to one another.

This graph shows the price of platinum and palladium over time:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

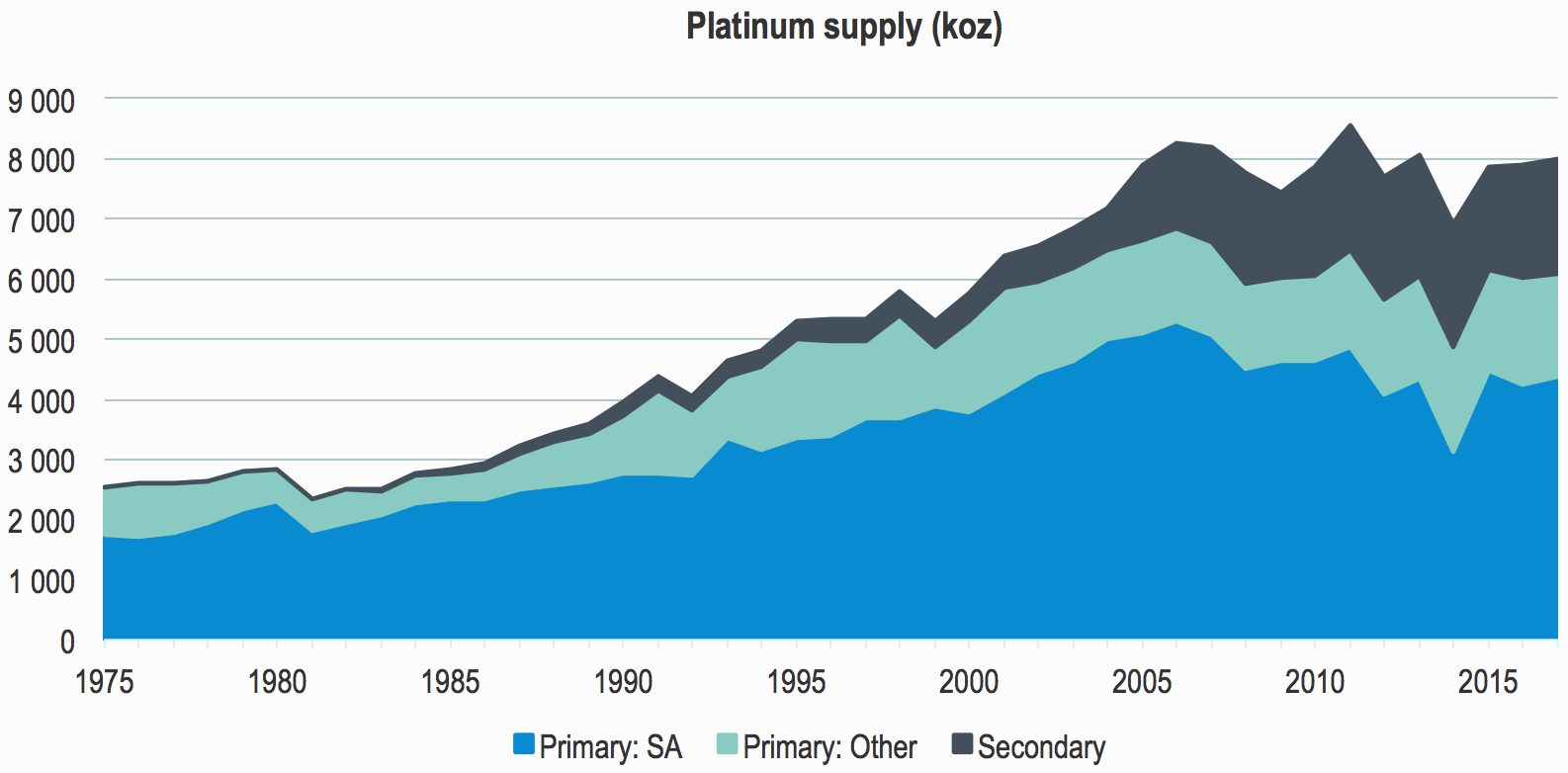

Around 70% of the world’s primary platinum supply comes from South Africa – ±4 200 kilo ounces (koz) per annum. Most of the mines are deep underground and labour intensive, with costs growing at above-inflation rate. At current PGM prices, more than half the industry is unprofitable. The status quo is not sustainable, and unprofitable supply needs to exit the market in order to set the balance right.

Lonmin, which represents about 700koz per annum of platinum supply, is on the brink of bankruptcy. Were it not for an all-share offer by Sibanye Stillwater late in December, the company would default on its debt. However, even though the entire 700 koz is not exiting the market, old shafts producing around 200–300koz are closing during the next couple of years, irrespective of bankruptcy.

Primary supply from South Africa has decreased by almost 1 000koz over the past decade. Unfortunately, this has been offset by an increase in recycled supply. Platinum is a very recyclable metal, which implies that more ounces need to exit the market if demand doesn’t respond. Based on past data, the rate at which recycled material enters the market appears to have normalised, which suggests that the incremental disruption of secondary supply is likely to be less going forward.

This graph shows a breakdown of platinum supply by source:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Impala Platinum is priced to be the next Lonmin, but we don’t believe this assessment is correct. The company can weather a further downturn, should it occur. Impala’s balance sheet carries little net debt, which was recently refinanced with a 2022 maturity. In addition, the company has further debt facilities in place until at least 2021.

Impala isn’t the weakest link in the industry, so a further downturn will likely lead to other producers removing supply from the industry first, which will have a positive impact on PGM pricing. Also, Impala is positioning itself to operate in a low PGM-price environment by closing unprofitable shafts over time and focusing on lower-cost growth shafts. The next couple of years will be uncomfortable, however, with further worker lay-offs and cost-cutting measures required.

In conclusion, we’re not overly optimistic about the South African platinum industry in the long term, but we believe the doom-and-gloom scenario, which the market is largely pricing in, is the less likely outcome. In our view, Impala Platinum is doing the necessary restructuring in order to survive even in a low PGM-price environment, with debt unlikely to be a problem in the next three years. We believe the investment case still makes sense, but patience is required to see it unfold.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.