Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

MultiChoice:

emancipated or abandoned?

Last month, Africa’s largest pay TV operator, MultiChoice, was unbundled from its parent company, Naspers, and listed as a separate entity on the JSE. Opinions vary on whether going it alone is a blessing or a curse for the pay TV and video entertainment pioneer – and whether investors should throw out or add to these odd-lot shares in their portfolios. In our view, MultiChoice shares currently offer good value, and despite some short-term potential headwinds, there is a long-term investment case to be made for the group.

There are few long-established companies in the world that have been able to keep transforming over the years to the extent global internet and media behemoth Naspers has. From its humble beginnings as a newspaper business in the early 20th century, the group branched out into the sphere of pay TV in 1986. The first pay TV operator to be launched outside the US, MultiChoice in turn planted the seeds for the Naspers Group’s impressive portfolio of consumer internet businesses, including China’s Tencent and the OLX Group.

The Naspers share price has grown exponentially on the back of its successful investments. However, over the past decade, the share has failed to keep up with the growth in the value of its investments, resulting in a large discount to intrinsic net asset value (as we discussed in June last year).

For many years, Naspers relied on the cash flows from MultiChoice to enable the group’s internet ventures to grow in scale. Tencent has been profitable, but it has paid a relatively small dividend to Naspers while the rest of the internet businesses have made a loss in aggregate. Then in 2018 Naspers suddenly found itself with a US$10 billion pile of cash following the sale of 6% of the group’s Tencent shares and the disposal of Indian online retailer Flipkart. At the same time, the group’s next growth engine, online classifieds, was starting to achieve profitability.

For the first time, Naspers was able to live without MultiChoice, and the pay TV operator could now be unbundled to shareholders as part of a wider strategy to unlock the discount in the share price. On 27 February 2019, the MultiChoice Group was listed as a separate entity on the JSE, and Naspers shareholders each received one MultiChoice share for every one Naspers share owned.

Let’s take a closer look at the newly listed broadcaster. Since Naspers launched its pay TV operation 32 years ago, MultiChoice has built its success on quality content that includes a leading local offering, sports broadcasting rights and access to top international studios. It has a fully invested network, which can provide a high-quality and fully encrypted signal to a large number of households in sub-Saharan Africa via satellite dish or digital terrestrial network in key major cities.

Scale is an important competitive advantage for pay TV operators, as it enables them to spread the cost of content over a larger subscriber base. As the largest player in its various markets, MultiChoice has a key competitive advantage over potential rivals with regard to content.

In addition, while pay TV penetration across Africa is growing, it remains low compared to international norms. Boosted by a growing and urbanising population, this provides plenty of room for long-term subscriber growth across the continent.

We’ve valued the MultiChoice Group (MCG) at around R200 per share. However, a number of factors lead us to believe that the share may trade well below its intrinsic value in the near future:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

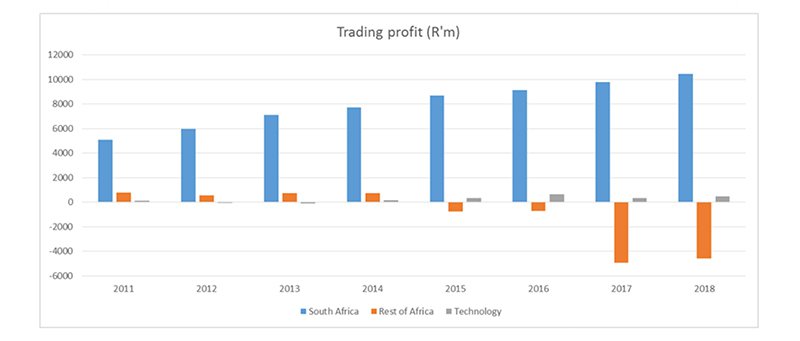

The sizable losses in the rest of Africa, as well as accounting for the 25% BEE minority holding in the SA business, fully taxed SA profits and revenue tax in certain African countries, have led to a relatively depressed earnings base for the group. For example, in the 2018 financial year, MultiChoice SA earned R10.5 billion in trading profit, but only R1.3 billion in core earnings was reported at group level (adjusted for the further 5% transfer to BEE shareholders in the SA business).

The material losses that MCG has to absorb for the rest of Africa therefore depresses the group’s reported earnings, which may lead to a lower market valuation relative to what the SA business alone is worth. On the other hand, if the group can successfully turn around profitability in the rest of Africa, it should be able to report strong future earnings growth from the current low base.

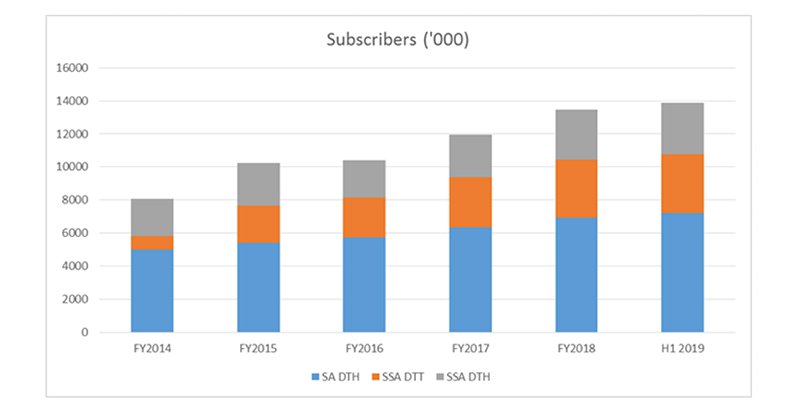

Despite the potential short-term overhang on MultiChoice, we do believe there’s a long-term investment case for the group. It has a strong portfolio of video content and sports broadcasting rights. There’s been much focus on the creation of local content, which differentiates it from international competitors. It also has the largest scale in its markets, which helps it to acquire better content as it can spread the cost over a larger subscriber base. Subscriber growth has been strong over recent years, although this was driven by lower-end packages carrying a lower monthly subscription. Pay TV subscription penetration in Africa is still very low compared to international standards, which provides plenty of runway for growth:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

MultiChoice is mainly a fixed-cost business, with the acquisition of content the biggest single cost item. The sharp depreciation of currencies in the countries in which it operates has been the biggest contributor to rising trading losses in its rest-of-African operations. The group has had to acquire a large portion of its content in US dollars and has struggled to pass on cost increases to subscribers in local currencies. The rest-of-Africa strategy is now to primarily focus on mass market subscriber growth in more affordable packages. While quick-win cost savings are being made by optimising content cost, the return to profitability in the rest of Africa will be driven by operating scale over time.

The strong growth in subscriber numbers does bring some short-term earnings headwinds, as MultiChoice provides generous subsidies to consumers for the installation of set-top boxes, costing the group around R3 billion per year (almost 50% of trading profit). The capex requirement on the network has declined over recent years, as the group’s network is now largely set up for its growth requirements. Operating leverage should therefore be quite favourable over the coming years if MultiChoice can keep the subscriber growth up.

Taking a conservative route, if we put a negative value of R15 billion on the non-SA operations, the current share price implies an 8.5 times price-to-earnings (P/E) ratio for the SA operations. This is attractive given the resilience and cash-generative nature of MultiChoice SA. If we value the rest of Africa in line with its medium-term potential at R10.7 billion, the market-implied value for the SA operations is only 4.5 times P/E. The share price may remain under pressure while the shareholder base stabilises, but with MultiChoice trading at around R95 at the timing of writing, we believe it is offering good value.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We can help you maximise your returns through an integrated investment plan tailor-made for you.

Niel Laubscher has spent 10 years in Investment Management.

Have a question for Niel?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.