Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

WAR IN UKRAINE: IMPACT

ON COMMODITY MARKETS

Russian President Vladimir Putin’s invasion of Ukraine and the subsequent sanctions placed on Russia by the West are having a profound impact on global commodity markets. How does this impact our clients’ portfolios, and in particular, our recent investment in Glencore?

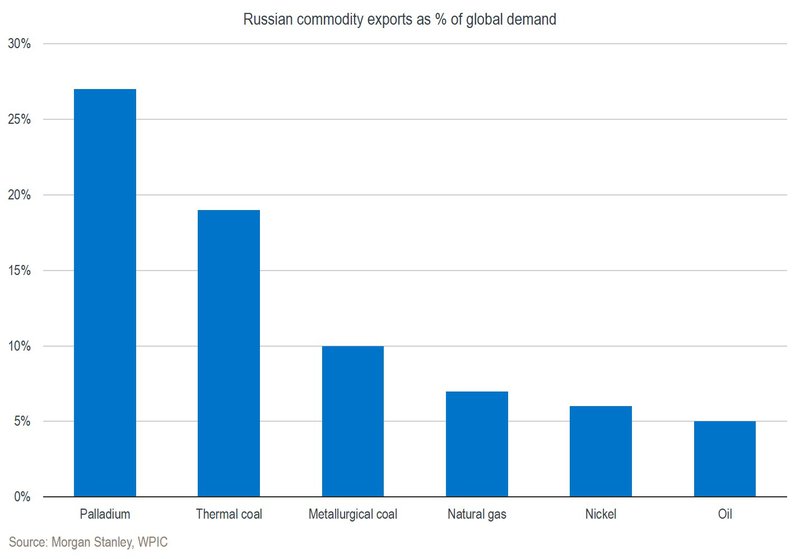

Russia is a major producer and exporter of raw materials, ranging from energy products (oil, gas and coal) to metals (including palladium, diamonds and nickel) and crops (Russia and Ukraine together export about a quarter of the world’s global wheat supply).

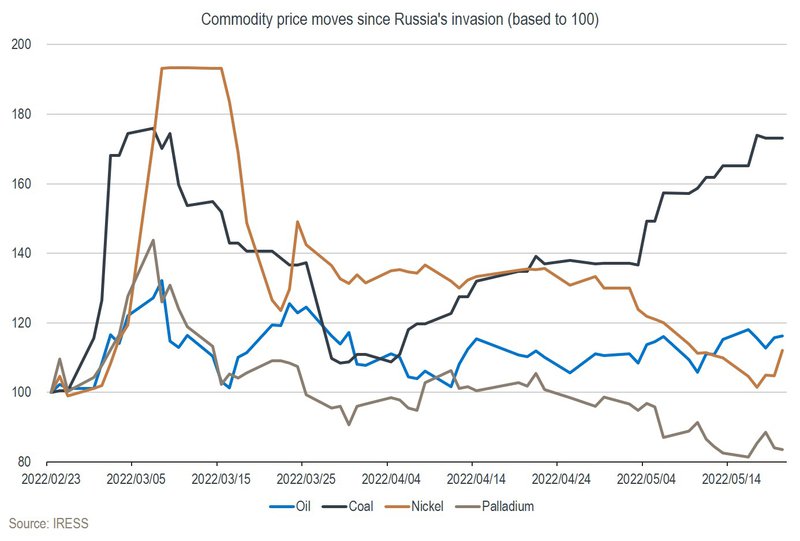

Russia’s share of global exports of select major metals and energy products, as well as these products’ price movements after the invasion of Ukraine, are indicated on the charts below:

The situation remains quite fluid and it’s difficult to predict when this war will end and how things will play out afterwards. However, we can put forward a few observations. Unless the Putin regime falls, we think it’s quite likely that sanctions on Russian products will remain for some time to come – which is likely to keep the prices of the commodities of which Russia is a major exporter elevated (eventually, supply from other jurisdictions will respond, but this will take time).

The biggest risk to this view is the potentially negative second-round impact of higher inflation on global economic growth. Sharply increasing prices typically lead to central banks raising interest rates to contain inflation, and then to demand destruction due to the decrease in consumer spending power.

In this case, the outcome may also turn out to be different for particular commodities. From a demand side, the negative impact is likely to be tilted towards more discretionary products first (for example, autos and platinum group metals (PGMs)) and then towards more inelastic products such as energy. In addition, commodities exposed to Chinese property (for example, steel and copper) may prove more resilient, with this country widely expected to stimulate its economy over the near term.

In terms of PGM demand, the medium term may well see an accelerated shift towards the use of more platinum at the expense of palladium in gasoline auto catalysts (which benefits South African PGM miners, where platinum is the dominant portion of the metals basket).

From a supply disruption side, the ease with which commodities can be moved plays a significant role. Precious metals transported by plane can more easily be re-routed to other destinations (such as China). However, bulk minerals such as oil, gas, coal and iron ore are much more difficult to move to alternative markets, and some Russian products may well be negatively impacted.

Let’s take thermal coal as an example. In its recent fifth sanctions package on Russia, the European Union announced sanctions on Russian coal from mid-August onwards. Russia exports nearly 20% of the ~1 billion ton per annum seaborne market. About a quarter of Russia’s product is currently exported to Europe, most of it railed over 4 000 kilometres from Siberia. Rail constraints make simply re-routing coal to Eastern ports difficult, which means that some of this product may be left stranded (in the near term at least).

This of course benefits other exporters of thermal coal, one example being Glencore, a company we recently added to many of our clients’ portfolios.

Glencore started out as a commodity trading business in the 1970s and has since grown into a ~US$90 billion mining company, most recently through its merger with Xstrata in 2013. The company’s commodity mix differs from that of its large mining peers (Anglo American and BHP) in a few critical ways:

Glencore’s approach to thermal coal has also been different to that of its peers – the company was an eager buyer of thermal coal assets when other big miners wanted to get rid of their coal exposure. Most recently, Glencore acquired Rio Tinto’s coal assets as well as the Cerrejon mine from partners BHP and Anglo American for very undemanding prices.

Glencore’s response to critics of this strategy has been that it’s better to have coal assets in the hands of someone who would run them down responsibly and reinvest the profits into green metal production (or return this cash to shareholders), as opposed to spinning these assets out into a dedicated coal producer more likely to reinvest profits into more coal mines.

In our view, this is a sensible approach, and it’s indeed turning out to be a profitable one for shareholders, with free cash flow yields in excess of ~25% at the time of writing – mostly from thermal coal. This means that if spot prices stay where they are, you’d make your money back within four years.

However, investing in Glencore doesn’t come without risks. Most notably, the company has been under investigation by several authorities for alleged corrupt dealings in Africa in particular. These investigations are, however, reaching a point where a settlement has all but been agreed on – the issue is therefore likely to be much less material than previously feared by the market.

This doesn’t mean Glencore is now a squeaky-clean operator, but we’ve seen strong action by the company to improve its governance over recent years, and no new issues have arisen for some time. As investors, we need to weigh up both the upside and downside risks, and in our view, the upside from coal and the company’s green metal portfolio more than outweighs the governance risks to the downside.

After being net buyers of miners for the past two years, we’ve recently started to cut back our overall exposure as share prices have rallied to beyond our fair values. However, we do maintain a healthy position with regard to the commodity producers in our clients’ portfolios due to a still-positive market outlook, at least over the near term. We have a deliberate tilt towards energy, where we think the investment case was particularly strong even before the war, on the back of a lack of investment by oil companies in general (see our recent article here).

We’ll continue to act in line with our investment philosophy, by taking profits in the cyclicals as share prices rise beyond our assessment of fair value. Ultimately, high commodity prices lead to either too much new supply coming online or to demand destruction (or both) – which in turn will result in commodity prices returning to more normal levels.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We can help you maximise your returns through an integrated investment plan tailor-made for you.

Niel Laubscher has spent 10 years in Investment Management.

Have a question for Niel?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.