Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

SA equities:

is it different this time?

The poor performance of equities – the South African market in particular – in recent weeks has left punch-drunk investors questioning the wisdom of remaining in shares. We’ve always argued that despite short-term market drama, traditional financial laws will hold sway over the long term – and that the five most dangerous words in investments are ‘this time it’s different’. Are we perhaps being naïve in not recognising that maybe this time, the market slump is different? The barrage of negative news we’re faced with on a daily basis in our country is, after all, hard to ignore – and foreign investors are certainly taking note.

In April, we held the view that provided our clients’ equity exposure is aligned with their investment requirements and risk profile, they should stay the course with this asset class – both locally and globally. We argued that if tried-and-tested financial laws continue to hold, patient investors will be justly rewarded through investment cycles for the extra risk taken in investing in equities. We also said the valuation of South African equities in particular wasn’t unreasonable, and it would therefore not make sense to sell assets that are no longer expensive.

South African shares have come under severe pressure in recent weeks, however, and disillusioned investors are increasingly looking to lower-risk asset classes to protect their capital. And it’s not only local equities that have slumped – US-listed shares that were the star performers on the international equity stage have also retreated from recent highs. The question is: were our earlier views naïve? Are shares still a wise choice under the circumstances?

We warned in April that sceptics would certainly argue that ‘normal’ financial laws may no longer be valid – that this time, it is different – for these reasons:

While there are clearly legitimate reasons for the dismal returns of equity markets of late, it should be remembered that when investors start to question a particular asset class, emotion – especially fear – is never far from the surface. And when jittery investors start overreacting and making decisions based on recent short-term experience, it’s usually at precisely the wrong time.

In a bull market, analysts love to quote one of legendary investor Warren Buffett’s golden rules of successful long-term investing: ‘Attempt to be fearful when others are greedy, and greedy only when others are fearful.’ The problem is it’s extremely tough to apply this rule in the face of overwhelmingly negative news flow and market reaction to it. As hedge fund manager Mark Sellers puts it: ‘Everyone thinks they can do this, but when the market is crashing, almost no one has the stomach to buy. When the market is going up almost every day, you can’t bring yourself to sell.’ In the current environment, the fear in the financial markets is palpable.

When we at Sanlam Private Wealth consider our investment strategy for clients’ money, we look only at the facts, not fads. We unemotionally consider price, focus our research effort on establishing the correct perspective, and rely on the evidence of historic price patterns to design a rational strategy that will best serve our clients’ long-term investment needs. In this process, we assess the relative attractiveness of all asset classes, both local and global.

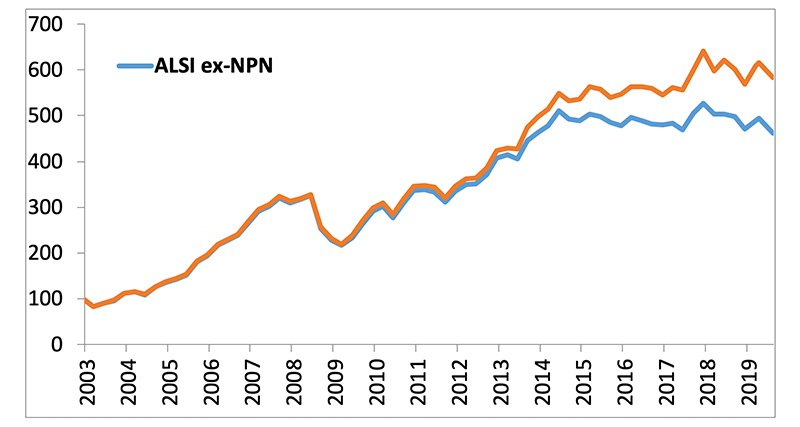

At the moment, it’s clear that the proverbial elephant in the room is the exposure our clients have to equities, particularly South African equities. There can be no doubt that the poor performance of shares in recent years has contributed significantly to the notion that ‘this time, it’s different’ for this asset class. The performance of local equities, excluding Naspers (blue line), versus that of the overall global equity market (orange line) can be seen on the chart below:

Global and local (ex-NPN) equity prices

Source: Bloomberg, SPW research

This chart clearly illustrates that:

In investment speak, one could argue that if you remove Naspers from the picture, local equities have in fact been in a bear market – and in our experience, investors don’t act rationally in bear markets. Normal investment principles, such as consideration for the value of an asset, play second fiddle to the narrative of the day. Indeed, this narrative is being extrapolated into perpetuity – investors see a low probability that the current tough circumstances will ease up any time soon and that the investment environment will revert back to what might be considered ‘normal’.

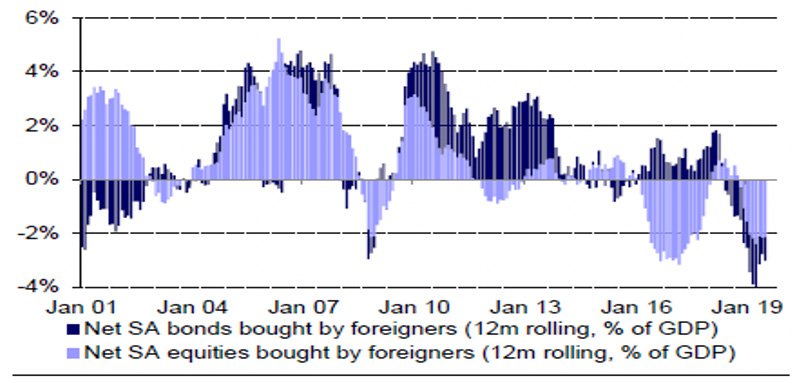

In response, investors have voted with their money. Given the policy uncertainty, fiscal risks and pedestrian economic growth in South Africa, foreign investors have been net sellers of local equities since 2016, and this trend has accelerated over the past few months as the macro news flow has deteriorated. In fact, foreign investors have also been selling off local bonds. In all, we’ve witnessed the biggest net sale of South African assets since the dark days of 2001.

The data certainly suggest that foreigners are acting in a fearful manner, as the chart below shows:

Foreign purchases/sales of SA equities and bonds

Source: FTSE/JSE, Credit Suisse research

So where does this leave South African investors? We still maintain that despite short-term setbacks, over the long term, price, perspective and pattern will continue to drive future performance. In our view, long-term investment principles, which have held sway for decades, will continue to apply despite all the short-term drama – there’s no reason why they should now suddenly be invalid. The notion of ‘buying when others are fearful’ is therefore not a naïve approach.

We’re not for a moment suggesting that we should ignore the current perspective of extreme uncertainty on both the local and global fronts – we should therefore continue to manage the asset allocation of portfolios actively. Investors should recognise, however, that markets are dynamic, and tend to price in concerns (which of course provides longer-term opportunities). In the current environment, markets have already responded to the poor outlook:

The bottom line is that we at Sanlam Private Wealth have not changed our long-term views on South African equity markets. We believe that investors who want to grow their wealth in real terms – over time – shouldn’t be too hasty in exiting this asset class. It’s likely that local share prices may decline even further over the short term. However, it’s important to remember that over the long term – and by this we mean at least 10 years – equities have consistently and significantly outperformed every other asset class. Of course, each investor’s proportionate exposure to equities needs to align with their unique risk profile and investment requirements.

We’re by no means arguing that investors should have unrealistic return expectations for equities. We can’t ignore the fact that the global economic cycle is mature, and we can’t expect our market to disengage from global trends. However, other asset classes are currently even less appealing from a long-term perspective. We struggle to understand why rational long-term investors would buy a 10-year German government bond and accept a guaranteed negative return of 0.4% if held until maturity. It simply doesn’t make sense when investors have the opportunity to instead buy a quality global share with a free cash flow yield in excess of 6% and with realistic company prospects of compounding earnings in the future.

In the final analysis, we don’t think it’s different this time. Yes, investors are now facing increased risks, both locally and globally, and there are of course no guarantees when it comes to investing. However, periodically increased risk isn’t uncommon within the broader context of traditional long-term investment cycles. The secret is to reduce risk in investment portfolios in good times, and then gradually increase risk during bad times – when the price is right. The increased risk in portfolios will then reward investors when – not if – the cycle improves.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Using your equity portfolio to secure credit allows you fast access to capital.

Sizwe Mkhwanazi has spent 14 years in Investment Management.

Have a question for Sizwe?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.